Asked by Sapna Rathod on Jun 23, 2024

Verified

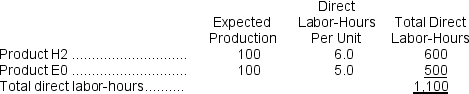

Spates, Inc., manufactures and sells two products: Product H2 and Product E0.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company's expected total manufacturing overhead is $266,468. If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to:

The company's expected total manufacturing overhead is $266,468. If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to:

A) $141.00 per unit

B) $123.42 per unit

C) $496.86 per unit

D) $1,453.44 per unit

Direct Labor-Hours

It measures the total hours worked by employees directly involved in manufacturing a product.

- Figure out overhead rates and use these figures to estimate costs of products in the scope of Activity-Based Costing.

- Understand how to allocate overhead costs using different activity drivers.

Verified Answer

SD

Sonali DhingraJun 30, 2024

Final Answer :

D

Explanation :

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $266,468 ÷ 1,100 DLHs = $242.24 per DLH (rounded)

Product H2: 6.0 DLHs × $242.24 per DLH = $1,453.44

= $266,468 ÷ 1,100 DLHs = $242.24 per DLH (rounded)

Product H2: 6.0 DLHs × $242.24 per DLH = $1,453.44

Learning Objectives

- Figure out overhead rates and use these figures to estimate costs of products in the scope of Activity-Based Costing.

- Understand how to allocate overhead costs using different activity drivers.