Asked by Vivian Terziario on May 11, 2024

Verified

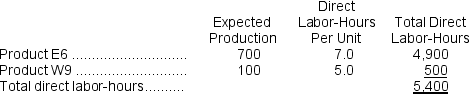

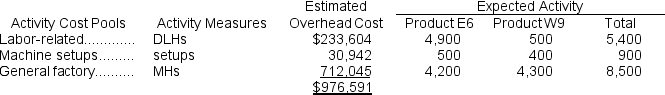

Moistner, Inc., manufactures and sells two products: Product E6 and Product W9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product E6 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product E6 would be closest to:

A) $586.39 per unit

B) $1,265.95 per unit

C) $302.82 per unit

D) $240.66 per unit

Direct Labor-Hours

The total hours worked by employees directly involved in the production process, often used as a basis for allocating overhead costs.

- Compute the rates of overhead and apply this computation to assess costs associated with products under the Activity-Based Costing method.

- Understand the methodology for distributing overhead costs by means of different activity drivers.

Verified Answer

SS

Sandeep SinghMay 16, 2024

Final Answer :

B

Explanation :

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $976,591 ÷ 5,400 DLHs = $180.85 per DLH (rounded)

Product E6: 7.0 DLHs × $180.85 per DLH = $1,265.95

Reference: CH04-Ref1

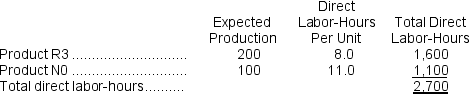

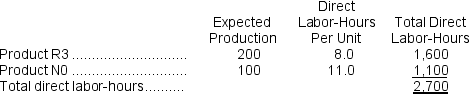

Arntson, Inc., manufactures and sells two products: Product R3 and Product N0.The annual production and sales of Product of R3 is 200 units and of Product N0 is 100 units.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below: The direct labor rate is $15.80 per DLH.The direct materials cost per unit is $287.80 for Product R3 and $104.80 for Product N0.

The direct labor rate is $15.80 per DLH.The direct materials cost per unit is $287.80 for Product R3 and $104.80 for Product N0.

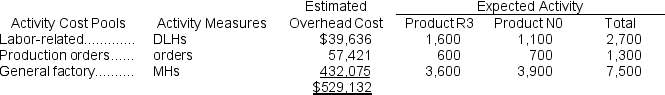

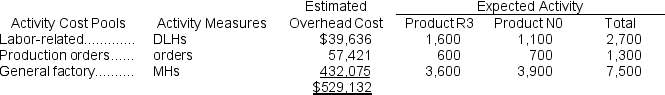

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

= $976,591 ÷ 5,400 DLHs = $180.85 per DLH (rounded)

Product E6: 7.0 DLHs × $180.85 per DLH = $1,265.95

Reference: CH04-Ref1

Arntson, Inc., manufactures and sells two products: Product R3 and Product N0.The annual production and sales of Product of R3 is 200 units and of Product N0 is 100 units.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:

The direct labor rate is $15.80 per DLH.The direct materials cost per unit is $287.80 for Product R3 and $104.80 for Product N0.

The direct labor rate is $15.80 per DLH.The direct materials cost per unit is $287.80 for Product R3 and $104.80 for Product N0.The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Learning Objectives

- Compute the rates of overhead and apply this computation to assess costs associated with products under the Activity-Based Costing method.

- Understand the methodology for distributing overhead costs by means of different activity drivers.