Asked by Jordan Tongen on Jun 10, 2024

Verified

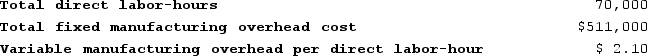

Session Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K913 was completed with the following characteristics:

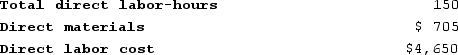

Recently, Job K913 was completed with the following characteristics:

The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $6,060

B) $2,115

C) $6,765

D) $5,355

Predetermined Overhead Rate

A calculated rate used to allocate overhead costs to products or cost objects based on a planned level of activity.

Direct Labor-Hours

The aggregate number of hours that workers, who are directly part of producing goods or services, contribute.

Job-Order Costing

A cost accounting system that assigns costs to specific production batches or jobs, enabling the calculation of the cost per job.

- Utilize the calculated predetermined overhead rate to apportion manufacturing overhead to jobs.

- Calculate the total manufacturing cost and the cost of goods sold for particular jobs within a job-order costing framework.

Verified Answer

Overhead rate = Estimated total overhead costs / Estimated total direct labor hours

= $245,000 / 35,000 = $7.00 per direct labor hour

Overhead applied to Job K913 = Direct labor hours for Job K913 x Overhead rate

= 187 x $7.00 = $1,309

Next, we need to calculate the total manufacturing cost for Job K913:

Total manufacturing cost = Direct materials + Direct labor + Manufacturing overhead applied

= $2,750 + $2,718 + $1,309

= $6,777

Finally, we can calculate the total job cost by adding any additional costs (such as selling and administrative costs), but since no additional information is given, we can assume that the total job cost is equal to the total manufacturing cost:

Total job cost for Job K913 = $6,777, which is closest to choice C.

Learning Objectives

- Utilize the calculated predetermined overhead rate to apportion manufacturing overhead to jobs.

- Calculate the total manufacturing cost and the cost of goods sold for particular jobs within a job-order costing framework.

Related questions

Valvano Corporation Uses a Job-Order Costing System with a Single ...

Janicki Corporation Has Two Manufacturing Departments--Machining and Customizing ...

Heroux Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Stoke Corporation Has Two Production Departments, Forming and Assembly ...

Thrall Corporation Uses a Job-Order Costing System with a Single ...