Asked by Brayan Checo Rosario on May 12, 2024

Verified

Prepare the required adjusting journal entry at December 31,2019,the end of the annual accounting period for the three items below.Assume that no adjusting entries have been made during the year.If no entry is required,explain why.

A.Polk Company acquired a patent that cost $6,000 on January 1,2019.The patent was registered on January 1,2015.The useful life of a patent is 20 years from registration.

B.Polk Company acquired a gravel pit on January 1,2019,that cost $24,000.The company estimates that 30,000 tons of gravel can be extracted economically.When all the gravel has been extracted,no residual value is anticipated.During 2019,4,000 tons were extracted and sold.

C.On January 1,2019,Polk Company acquired a used dump truck that cost $6,000 to use hauling gravel.The company estimated a residual value of 10% of cost and a useful life 4 years.The company uses straight-line depreciation.

Residual Value

The expected value of an asset at the end of its useful life, typically used in the context of leasing or depreciation.

Useful Life

The estimated period over which an asset is expected to be usable by the organization.

- Construct journal adjustments for asset depreciation, amortization, and impairment.

Verified Answer

BW

Brynne WolfeMay 13, 2024

Final Answer :

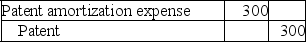

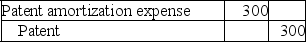

A.

$6,000 ÷ 20 years = $300/year

$6,000 ÷ 20 years = $300/year

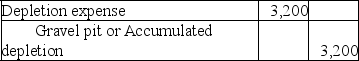

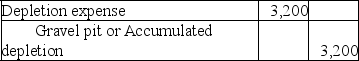

B.

$24,000 ÷ 30,000 = $.80

$24,000 ÷ 30,000 = $.80

$.80 × 4,000 tons = $3,200

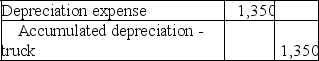

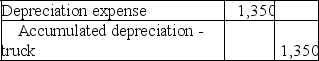

C.

$6,000 × .90 = $5,400 to be depreciated

$6,000 × .90 = $5,400 to be depreciated

$5,400 ÷ 4 years = $1,350

$6,000 ÷ 20 years = $300/year

$6,000 ÷ 20 years = $300/yearB.

$24,000 ÷ 30,000 = $.80

$24,000 ÷ 30,000 = $.80$.80 × 4,000 tons = $3,200

C.

$6,000 × .90 = $5,400 to be depreciated

$6,000 × .90 = $5,400 to be depreciated$5,400 ÷ 4 years = $1,350

Learning Objectives

- Construct journal adjustments for asset depreciation, amortization, and impairment.