Asked by Keandra Moffitt on Jul 16, 2024

Verified

A company purchased and installed equipment on January 1 at a total cost of $72,000.Straight-line depreciation was calculated based on the assumption of a five-year life and no salvage value.The equipment was disposed of on July 1 of the fourth year.The company uses the calendar year.

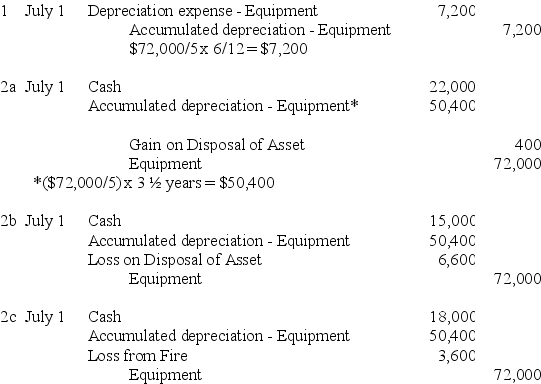

1.Prepare the general journal entry to update depreciation to July 1 in the fourth year.

2.Prepare the general journal entry to record the disposal of the equipment under each of these three independent situations:

a.The equipment was sold for $22,000 cash.

b.The equipment was sold for $15,000 cash.

c.The equipment was totally destroyed in a fire and the insurance company settled the claim for $18,000 cash.

Straight-Line Depreciation

Straight-line depreciation is a method of allocating the cost of a fixed asset evenly over its useful life, assuming a constant rate of depreciation each year.

Journal Entry

A record in accounting that notes every transaction, detailing the accounts affected and the amounts charged or credited.

Equipment Disposal

The process of getting rid of fixed assets such as machinery or equipment, typically due to obsolescence, replacement, or sale.

- Acquire the ability to execute adjusting journal entries to account for depreciation and the disposal of assets.

- Understand and describe the methods of accounting for the disposal of assets, which includes determining the financial outcome as a gain or loss.

Verified Answer

AZ

Learning Objectives

- Acquire the ability to execute adjusting journal entries to account for depreciation and the disposal of assets.

- Understand and describe the methods of accounting for the disposal of assets, which includes determining the financial outcome as a gain or loss.