Asked by Brianna Prater on Jun 11, 2024

Verified

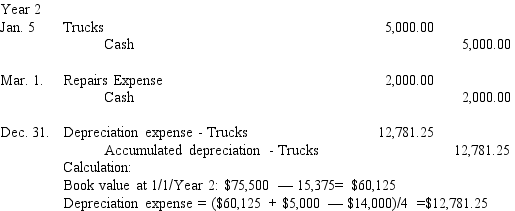

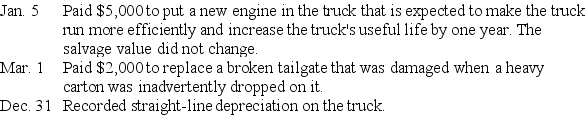

In year one,McClintock Co.acquired a truck that cost $75,500 with an estimated $14,000 salvage value and 4 year estimated useful life.Depreciation in the first year was $15,375.McClintock had the following transactions involving plant assets during Year 2.Unless otherwise indicated,all transactions were for cash.

Prepare the general journal entries to record these transactions.

Prepare the general journal entries to record these transactions.

Salvage Value

The projected resale price of an asset upon reaching the end of its useful period, accounted for in computing depreciation.

Plant Assets

Long-term tangible assets that are used in the operation of a business and are not intended for resale.

Depreciation Expense

Apportioning a physical asset’s cost over its estimated useful life.

- Develop the skills to record depreciation and asset disposals through adjusting journal entries.

- Differentiate between the accounting treatments of revenue expenditures and capital expenditures.

Verified Answer

AK

Learning Objectives

- Develop the skills to record depreciation and asset disposals through adjusting journal entries.

- Differentiate between the accounting treatments of revenue expenditures and capital expenditures.