Asked by loveneet singh on Jun 24, 2024

Verified

Benson Mining Company purchased a site containing a mineral deposit during 2019.The purchase price was $820,000,and the site is estimated to contain 400,000 tons of extractable ore.Benson constructed a building at the site,at a cost of $500,000,to be used while the ore is being extracted.When the ore reserves are gone,the building will have no further value.

A.Explain the objective of recording depletion of natural resources.

B.Determine Benson's depletion rate per ton of ore.

C.Prepare the journal entry to record depletion for the year 2019,when Benson mined and sold 150,000 tons of ore.

D.Prepare the journal entry to record depreciation on the building for 2019.Benson calculates depreciation on the building using the units-of-production method based on the amount of ore extracted (150,000 tons in 2019).

Depletion Rate

The rate at which a natural resource is used or consumed, important for accounting and valuation of resource-based companies.

Extractable Ore

Refers to the portion of a mineral or natural resource deposit that can be economically and legally extracted or produced at the time of consideration.

Units-Of-Production Method

An approach to depreciation that allocates an asset's cost based on its use, output, or production, rather than passing time.

- Comprehend the accounting concepts related to depletion of natural resources.

- Develop entries for adjusting depreciation, amortization, and impairment losses on assets in the journal.

Verified Answer

B.$820,000 ÷ 400,000 tons = $2.05 per ton

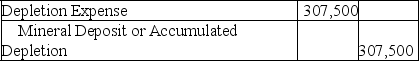

C.

$2.05 × 150,000 tons

$2.05 × 150,000 tonsD.

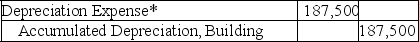

*($500,000 ÷ 400,000 tons)× 150,000 tons

*($500,000 ÷ 400,000 tons)× 150,000 tons

Learning Objectives

- Comprehend the accounting concepts related to depletion of natural resources.

- Develop entries for adjusting depreciation, amortization, and impairment losses on assets in the journal.

Related questions

Prepare the Required Adjusting Journal Entry at December 31,2019,the End ...

Describe the Accounting for Natural Resources,including Their Acquisition,cost Allocation,and Account ...

A Company Purchased a Special Purpose Machine on September 15 ...

On January 2,2010,a Company Purchased a Delivery Truck for $45,000 ...

In Year One,McClintock Co ...