Asked by OLUSEGUN ADELEKE on Jul 21, 2024

Verified

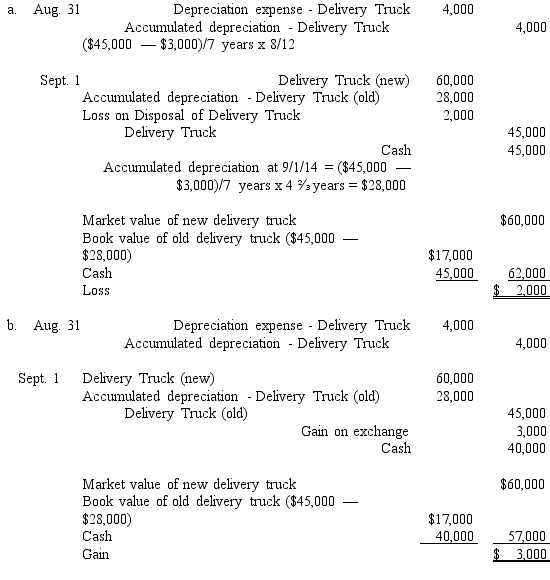

On January 2,2010,a company purchased a delivery truck for $45,000 cash.The truck had an estimated useful life of seven years and an estimated salvage value of $3,000.The straight-line method of depreciation was used.Prepare the journal entries to record depreciation expense and the disposition of the truck on September 1,2014,under each of the following assumptions:

a.The truck and $45,000 cash were given in exchange for a new delivery truck that had a cash price of $60,000.This transaction has commercial substance.

b.The truck and $40,000 cash were exchanged for a new delivery truck that had a cash price of $60,000.This transaction has commercial substance.

Straight-Line Method

A technique for computing depreciation that involves uniformly distributing an asset's cost throughout its lifespan.

Salvage Value

The anticipated concluding value of an asset at the expiration of its operational period.

Commercial Substance

A concept in accounting that a transaction has commercial substance if it significantly changes the economic position or cash flows of the company.

- Learn to make adjusting journal entries for the purpose of documenting depreciation and the disposal of assets.

- Identify and elucidate the financial processes involved in asset disposals, encompassing the computation of profit or loss resulting from such disposals.

Verified Answer

OB

Learning Objectives

- Learn to make adjusting journal entries for the purpose of documenting depreciation and the disposal of assets.

- Identify and elucidate the financial processes involved in asset disposals, encompassing the computation of profit or loss resulting from such disposals.