Asked by Meghan Maratea on Apr 29, 2024

Verified

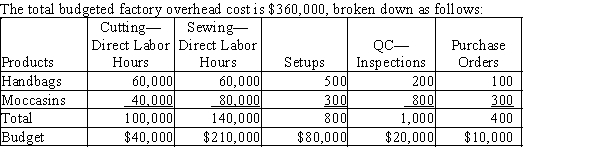

Pikes Peak Leather Company manufactures leather handbags and moccasins. The company has been using the single plantwide factory overhead rate method but has decided to evaluate the activity-based costing method to allocate factory overhead. The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.  Determine the amount of factory overhead to be allocated to each unit using activity-based costing. The company plans to produce 60,000 handbags and 40,000 moccasins.

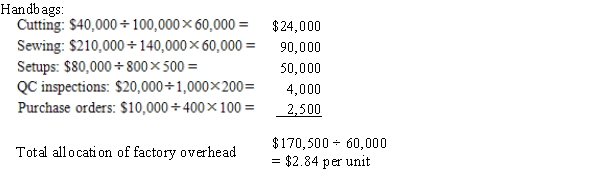

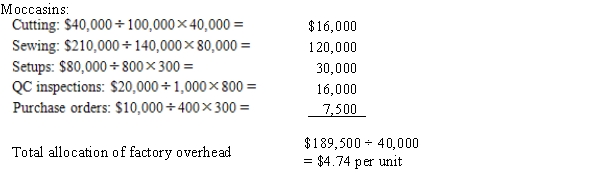

Determine the amount of factory overhead to be allocated to each unit using activity-based costing. The company plans to produce 60,000 handbags and 40,000 moccasins.

Activity-based Costing

A method of accounting that assigns costs to specific activities based on their use of resources, providing more accurate product costing.

Factory Overhead

Indirect costs associated with manufacturing, such as maintenance, utilities, and salaries, not directly tied to production output.

Selling Prices

The cost at which a service or product is made available to purchasers.

- Implement activity-based costing methodology for the apportionment of indirect costs to diverse products or services.

Verified Answer

Learning Objectives

- Implement activity-based costing methodology for the apportionment of indirect costs to diverse products or services.

Related questions

Tulip Company Produces Two Products, T and U ...

Valhalla Company Manufactures Small Table Lamps and Desk Lamps ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

The Following Data Have Been Provided by Hooey Corporation from ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...