Asked by Frasier Williamson on May 06, 2024

Verified

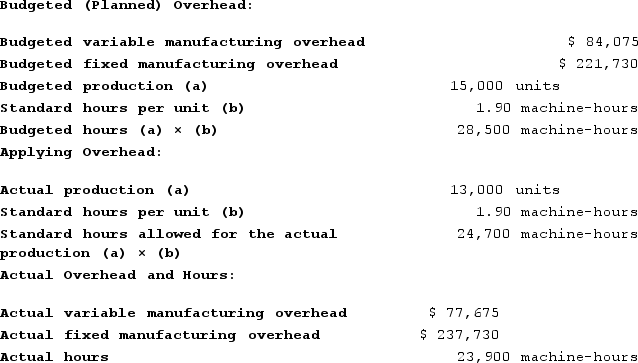

Berk Incorporated makes a single product--a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a.Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Determine the variable overhead rate variance for the year.

d. Determine the variable overhead efficiency variance for the year.

e. Determine the fixed overhead budget variance for the year.

f. Determine the fixed overhead volume variance for the year.

Variable Component

A part of cost or expense that fluctuates with changes in production volume or activity level.

Fixed Component

Part of a company's costs that do not change with the level of production or sales, such as rent, salaries, and insurance.

Predetermined Overhead Rate

A rate used to allocate overhead costs to products or services, calculated based on estimated costs and activity levels before the actual costs are known.

- Identify differing variances associated with manufacturing overhead, comprising budget, volume, rate, and efficiency variances.

- Analyze the variables of a predetermined overhead rate and the formula used in its calculation.

Verified Answer

b. Fixed component of the predetermined overhead rate = $221,730/28,500 machine-hours = $7.78 per machine-hour

c. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($77,675) − (23,900 machine-hours × $2.95 per machine-hour)

= ($77,675) − ($70,505)

= $7,170 Unfavorable

d. Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (23,900 machine-hours − 24,700 machine-hours) × $2.95 per machine-hour

= (−800 machine-hours) × $2.95 per machine-hour

= $2,360 Favorable

e. Budget variance = Actual fixed overhead − Budgeted fixed overhead = $237,730 − $221,730 = $16,000 Unfavorable

f. Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $221,730 − ($7.78 per machine-hour × 24,700 machine-hours)

= $221,730 − ($192,166)

= $29,564 Unfavorable

Learning Objectives

- Identify differing variances associated with manufacturing overhead, comprising budget, volume, rate, and efficiency variances.

- Analyze the variables of a predetermined overhead rate and the formula used in its calculation.

Related questions

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...

Held Incorporated Makes a Single Product--An Electrical Motor Used in ...

Modine Corporation Has Provided the Following Data for September ...

Edlow Incorporated Makes a Single Product--A Critical Part Used in ...

Wangerin Corporation Applies Overhead to Products Based on Machine-Hours ...