Asked by Jason Rosete on May 12, 2024

Verified

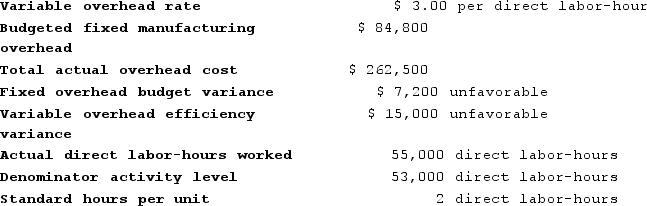

You have just been hired as the controller of the Eastern Division of Global Manufacturing. Performance records for last year are incomplete, with only the following data available:

Required:

Required:

Prepare a complete analysis of manufacturing overhead for the past year. Indicate actual, standard, and denominator activity levels; variable overhead rate and efficiency variances; and fixed manufacturing overhead budget and volume variances.

Manufacturing Overhead

Costs that are incurred in the manufacturing process other than direct materials and direct labor, such as utilities, depreciation, and maintenance of equipment.

Denominator Activity Levels

Denominator activity levels refer to the levels of activity used to allocate fixed costs to products or services under activity-based costing or other costing methodologies.

Efficiency Variances

The difference between the actual amount of resources used in production and the standard amount expected, showing how efficiently resources are being used.

- Measure distinctive variances pertaining to manufacturing overhead, consisting of budget, volume, rate, and efficiency variances.

- Evaluate the financial outcomes concerning standard and actual costs in manufacturing.

- Develop skills in preparing complete standard costing analysis, including variance analysis.

Verified Answer

PS

pardeep singhMay 18, 2024

Final Answer :

Budgeted fixed overhead rate = Fixed overhead ÷ Denominator quantity

= $84,800 ÷ 53,000 direct labor-hours

= $1.60 per direct labor-hour

Actual fixed manufacturing overhead = Budgeted fixed manufacturing overhead + Budget variance

= $84,800 + $7,200

= $92,000

Actual variable overhead = Total actual overhead − Actual fixed manufacturing overhead

= $262,500 − $92,000

= $170,500

Actual variable overhead rate = Actual variable overhead ÷ Actual hours

= $170,500 ÷ 55,000 direct labor-hours

= $3.10 per direct labor-hour

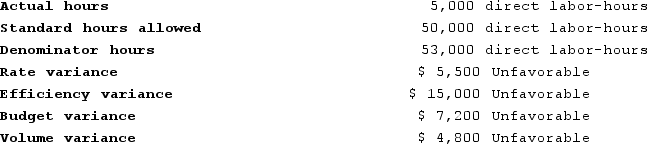

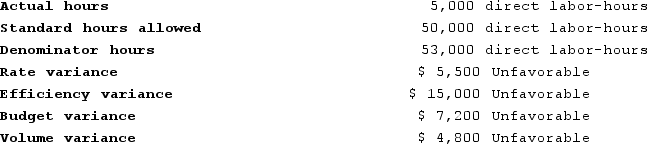

Rate variance = Actual hours (Actual rate − Standard rate)

= 55,000 hours ($3.10 per hour − $3.00 per hour)

= $5,500 Unfavorable

Standard hours × Standard rate = Actual hours × Standard rate − overhead efficiency variance

= 55,000 hours × $3.00 per hour − $15,000

= $150,000

Standard hours allowed = (Standard hours × Standard rate) ÷ Standard rate

= $150,000 ÷ $3.00 per direct labor-hour

= 50,000 direct labor-hours

Actual units produced = Standard hours allowed ÷ Standard hours per unit

= 50,000 hours ÷ 2 hours per unit

= 25,000 units

Volume variance = Budgeted fixed − (Standard hours × Standard rate)

= $84,800 − (50,000 hours × $1.60 per hour)

= $84,800 − $80,000

= $4,800 Unfavorable

Summary:

= $84,800 ÷ 53,000 direct labor-hours

= $1.60 per direct labor-hour

Actual fixed manufacturing overhead = Budgeted fixed manufacturing overhead + Budget variance

= $84,800 + $7,200

= $92,000

Actual variable overhead = Total actual overhead − Actual fixed manufacturing overhead

= $262,500 − $92,000

= $170,500

Actual variable overhead rate = Actual variable overhead ÷ Actual hours

= $170,500 ÷ 55,000 direct labor-hours

= $3.10 per direct labor-hour

Rate variance = Actual hours (Actual rate − Standard rate)

= 55,000 hours ($3.10 per hour − $3.00 per hour)

= $5,500 Unfavorable

Standard hours × Standard rate = Actual hours × Standard rate − overhead efficiency variance

= 55,000 hours × $3.00 per hour − $15,000

= $150,000

Standard hours allowed = (Standard hours × Standard rate) ÷ Standard rate

= $150,000 ÷ $3.00 per direct labor-hour

= 50,000 direct labor-hours

Actual units produced = Standard hours allowed ÷ Standard hours per unit

= 50,000 hours ÷ 2 hours per unit

= 25,000 units

Volume variance = Budgeted fixed − (Standard hours × Standard rate)

= $84,800 − (50,000 hours × $1.60 per hour)

= $84,800 − $80,000

= $4,800 Unfavorable

Summary:

Learning Objectives

- Measure distinctive variances pertaining to manufacturing overhead, consisting of budget, volume, rate, and efficiency variances.

- Evaluate the financial outcomes concerning standard and actual costs in manufacturing.

- Develop skills in preparing complete standard costing analysis, including variance analysis.