Asked by Emily Keith on May 16, 2024

Verified

On July 31,Orwell Co.has $448,800 of accounts receivable.

Required:

1.Prepare journal entries to record the following selected August transactions.The company uses the perpetual inventory system.

2.Explain what should be included in the footnotes to the August 31 financial statements as a result of these transactions.

3.Calculate the balance in the Accounts Receivable account as of August 10.

Perpetual Inventory System

The perpetual inventory system continuously updates inventory records for each purchase and sale transaction, providing real-time inventory levels.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity, typically including a balance sheet, income statement, and cash flow statement.

- Inculcate understanding of the foundational principles and procedures in accounting for receivables that are not collectible.

- Foster the development of skills in recording journal entries for transactions concerning bad debts and note receivables.

- Analyze the financial impact of bad debt accounting choices on the financial statements.

Verified Answer

MV

Maryam VahdatiMay 21, 2024

Final Answer :

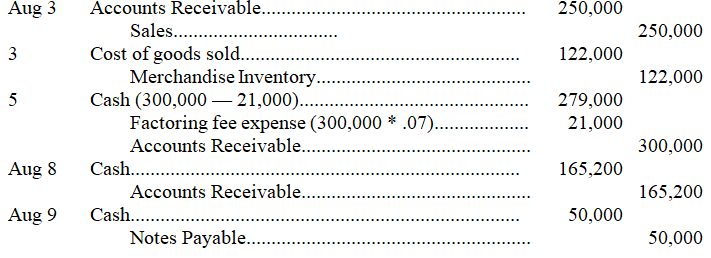

1.

2.Orwell should include the following note with its statements:

Accounts receivable of $65,000 are pledged as security for a $50,000 note payable.

3.Accounts receivable balance: $233,600 (448,800 + 250,000 - 300,000 - 165,200)

2.Orwell should include the following note with its statements:

Accounts receivable of $65,000 are pledged as security for a $50,000 note payable.

3.Accounts receivable balance: $233,600 (448,800 + 250,000 - 300,000 - 165,200)

Learning Objectives

- Inculcate understanding of the foundational principles and procedures in accounting for receivables that are not collectible.

- Foster the development of skills in recording journal entries for transactions concerning bad debts and note receivables.

- Analyze the financial impact of bad debt accounting choices on the financial statements.

Related questions

On May 31,Cray Has $375,800 of Accounts Receivable ...

Owens Company Uses the Direct Write-Off Method of Accounting for ...

A Company Uses the Aging of Accounts Receivable Method to ...

At December 31 of the Current Year,a Company Reported the ...

Prepare General Journal Entries for the Following Transactions of Norman ...