Asked by Santana Williams on Jun 16, 2024

Verified

On May 31,Cray has $375,800 of accounts receivable.Cray uses the allowance method of accounting for bad debts and has an existing credit balance in the allowance for doubtful accounts of $14,250.

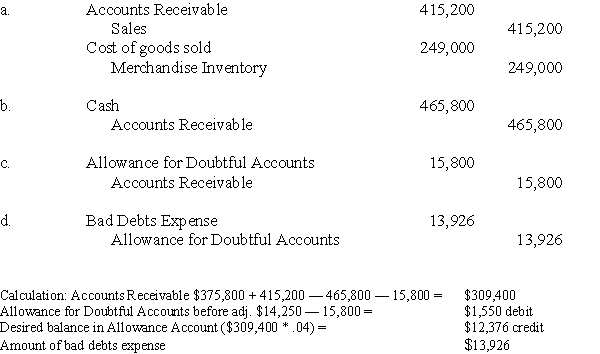

1.Prepare journal entries to record the following selected May transactions.The company uses the perpetual inventory system.

a.Sold $415,200 of merchandise (that cost $249,000)to customers on credit.

b.Received $465,800 cash in payment of accounts receivable.

c.Wrote off $15,800 of uncollectible accounts receivable.

d.In adjusting the accounts on May 31,its fiscal year-end,the company estimated that 4.0% of accounts receivable will be uncollectible.

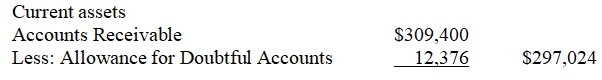

2.Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its May 31 balance sheet.

Allowance Method

An accounting technique used to account for accounts receivable that a company does not expect to collect fully, thereby creating an allowance for doubtful accounts.

Perpetual Inventory System

An inventory accounting method that instantly records inventory sales or purchases using computerized point-of-sale systems and enterprise asset management software.

Accounts Receivable

This refers to the money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

- Acquire knowledge of the principles and methodologies used in accounting for accounts receivable that are deemed uncollectible.

- Develop expertise in the formulation of journal entries related to transactions involving bad debts and note receivables.

- Acquire knowledge on how to estimate bad debts expense by understanding the allowance method and the direct write-off method.

Verified Answer

Learning Objectives

- Acquire knowledge of the principles and methodologies used in accounting for accounts receivable that are deemed uncollectible.

- Develop expertise in the formulation of journal entries related to transactions involving bad debts and note receivables.

- Acquire knowledge on how to estimate bad debts expense by understanding the allowance method and the direct write-off method.

Related questions

A Company Has the Following Unadjusted Account Balances at December ...

The Following Series of Transactions Occurred During Year 1 and ...

Thatcher Company Had a January 1,credit Balance in Its Allowance ...

Prepare General Journal Entries for the Following Transactions of Norman ...

At December 31 of the Current Year,a Company Reported the ...

2.

2.