Asked by Helmut Andres Florencia Roldan on Jun 12, 2024

Verified

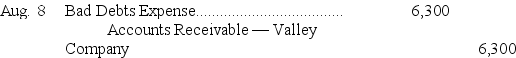

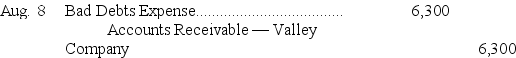

Owens Company uses the direct write-off method of accounting for uncollectible accounts receivable.On December 6,Year 1,Owens sold $6,300 of merchandise to the Valley Company.On August 8,Year 2,after numerous attempts to collect the account,Owens determined that the account of the Valley Company was uncollectible.

a.Prepare the journal entry required to record the transactions on August 8.

b.Assuming that the $6,300 is material,explain how the direct write-off method violates the expense recognition principle in this case.

Direct Write-off Method

A method of accounting for bad debts that directly writes off specific debts as they are deemed unrecoverable.

Uncollectible Accounts

Uncollectible accounts are debts from customers that a company has attempted to collect but determined they cannot be recovered and are thus written off as a loss.

Expense Recognition Principle

An accounting principle that dictates the conditions under which an expense is recognized and reported in the financial statements.

- Immerse in the concepts and methodologies pertinent to accounting for bad debts within accounts receivable.

- Advance your ability in orchestrating journal entries for transactions related to bad debts and note receivables.

- Comprehend the importance of the expense recognition principle in accounting for bad debts.

Verified Answer

LG

Lorena GongoraJun 18, 2024

Final Answer :

a.

b.In this case,the Bad Debts Expense was recorded in Year 2,but the sale was recorded in Year 1.Extending credit to customers helped produce the sales.The bad debts expense was recorded in a different period from the sale it helped to produce which violates the expense recognition principle.

b.In this case,the Bad Debts Expense was recorded in Year 2,but the sale was recorded in Year 1.Extending credit to customers helped produce the sales.The bad debts expense was recorded in a different period from the sale it helped to produce which violates the expense recognition principle.

b.In this case,the Bad Debts Expense was recorded in Year 2,but the sale was recorded in Year 1.Extending credit to customers helped produce the sales.The bad debts expense was recorded in a different period from the sale it helped to produce which violates the expense recognition principle.

b.In this case,the Bad Debts Expense was recorded in Year 2,but the sale was recorded in Year 1.Extending credit to customers helped produce the sales.The bad debts expense was recorded in a different period from the sale it helped to produce which violates the expense recognition principle.

Learning Objectives

- Immerse in the concepts and methodologies pertinent to accounting for bad debts within accounts receivable.

- Advance your ability in orchestrating journal entries for transactions related to bad debts and note receivables.

- Comprehend the importance of the expense recognition principle in accounting for bad debts.