Asked by Tyree McDonald on May 08, 2024

Verified

At December 31 of the current year,a company reported the following:

Total sales for the current year: $980,000 includes $160,000 in cash sales

Accounts receivable balance at Dec.31,end of current year: $160,000

Allowance for Doubtful Accounts balance at January 1,beginning of current year: $7,300 credit

Bad debts written off during the current year: $5,800.

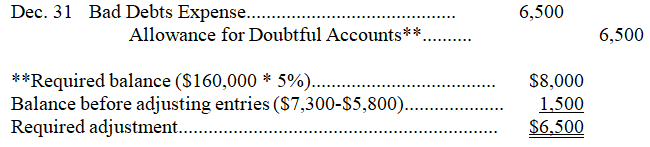

Prepare the necessary adjusting entries to record bad debts expense assuming this company's bad debts are estimated to equal 5% of accounts receivable.

Accounts Receivable

Funds that are owed to a company by customers for goods or services delivered or used but not yet paid for, typically within a short-term period.

Allowance for Doubtful Accounts

A contra-asset account that represents the estimated portion of accounts receivable that may not be collectible.

Bad Debts Expense

The amount of receivables that a company does not expect to collect and thus writes off as a loss in its accounting records.

- Learn the theoretical and operational framework for accounting for doubtful accounts.

- Understand the techniques for calculating bad debts expense, encompassing both the allowance and direct write-off methods.

- Gain insight into utilizing aged receivables for the estimation of allowances for doubtful accounts.

Verified Answer

Learning Objectives

- Learn the theoretical and operational framework for accounting for doubtful accounts.

- Understand the techniques for calculating bad debts expense, encompassing both the allowance and direct write-off methods.

- Gain insight into utilizing aged receivables for the estimation of allowances for doubtful accounts.

Related questions

Owens Company Uses the Direct Write-Off Method of Accounting for ...

Jordan CoUses the Allowance Method of Accounting for Uncollectible Accounts ...

A Company Uses the Aging of Accounts Receivable Method to ...

On July 31,Orwell Co.has $448,800 of Accounts Receivable ...

Thatcher Company Had a January 1,credit Balance in Its Allowance ...