Asked by Sydnee Frakes on Jun 22, 2024

Verified

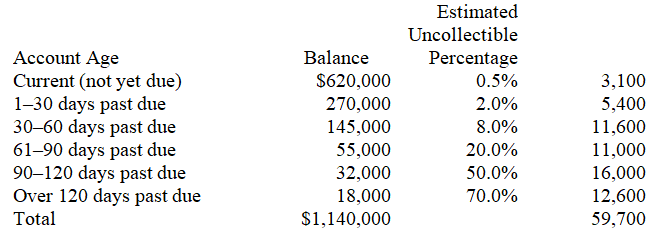

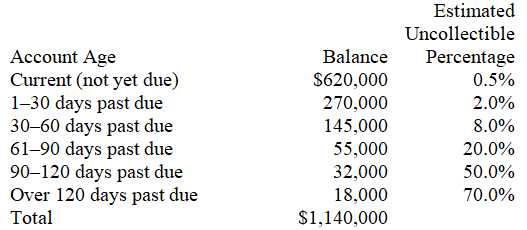

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a.Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

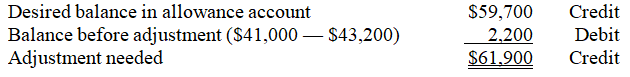

b.Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement,assuming that the credit balance of the Allowance for Doubtful Accounts on January 1 of the current year was $41,000 and that accounts receivable written off during the current year totaled $43,200.

c.Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

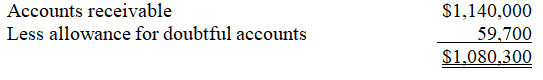

d.Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Aging of Accounts Receivable

A document or method that organizes a business's accounts receivable based on the duration an invoice has remained unpaid.

Bad Debts Expense

An expense reported on the income statement, representing the non-collectable accounts receivable from extending credit to customers.

Allowance for Doubtful Accounts

An estimation of the amount of accounts receivable that is not expected to be collected, used to create a more accurate picture of a company's financial health.

- Master the technique of using aged receivables to predict the allowance for doubtful accounts.

- Obtain knowledge on the principles and operation of accounting for bad debt accounts.

- Absorb the principles for evaluating bad debts expense, particularly the allowance method and the direct write-off method.

Verified Answer

VB

Learning Objectives

- Master the technique of using aged receivables to predict the allowance for doubtful accounts.

- Obtain knowledge on the principles and operation of accounting for bad debt accounts.

- Absorb the principles for evaluating bad debts expense, particularly the allowance method and the direct write-off method.