Asked by Becca Moore on Jun 14, 2024

Verified

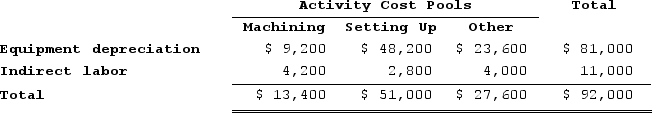

Musich Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.

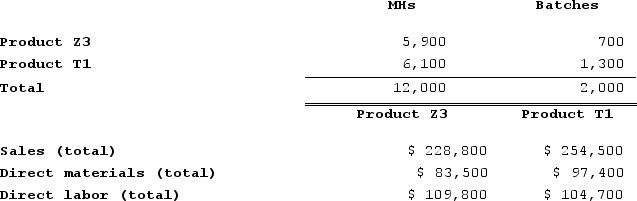

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

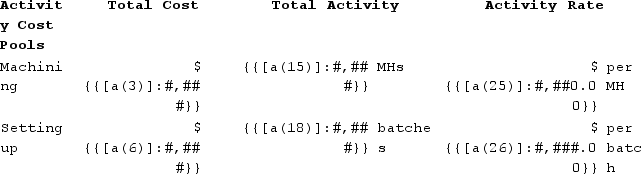

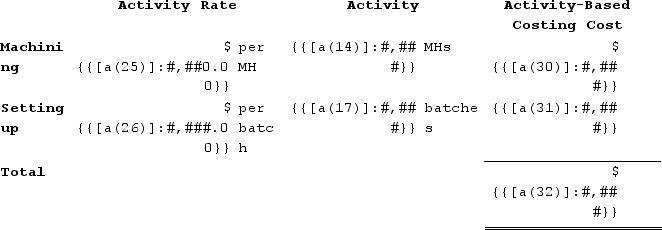

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing.

Activity-Based Costing

An accounting method that assigns overhead and indirect costs to related products and services by identifying cost drivers.

Machine-Hours

Machine-Hours measure the amount of time machines are in operation during a certain period, often used for allocating machine-related expenses to products.

Activity Cost Pools

A method in cost accounting where costs are accumulated according to the activities that incur them.

- Using activity-based costing, accurately apportion indirect costs among products.

- Ascertain product margins through the application of activity-based costing approaches.

Verified Answer

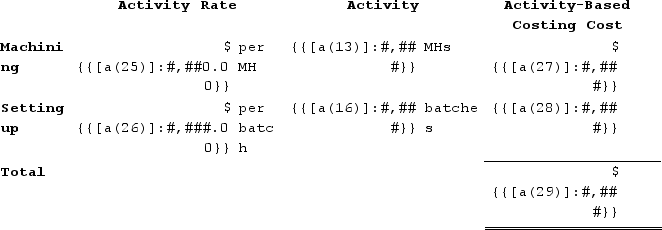

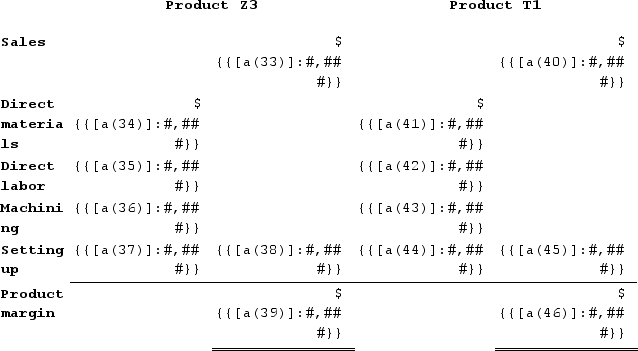

b.Assign overhead costs to products:Overhead cost for Product Z3:

b.Assign overhead costs to products:Overhead cost for Product Z3: Overhead cost for Product T1:

Overhead cost for Product T1: c.Determine product margins:

c.Determine product margins:

Learning Objectives

- Using activity-based costing, accurately apportion indirect costs among products.

- Ascertain product margins through the application of activity-based costing approaches.

Related questions

Mcnamee Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

The Following Data Have Been Provided by Hooey Corporation from ...

Beckley Corporation Has Provided the Following Data from Its Activity-Based ...

Moorman Corporation Has an Activity-Based Costing System with Three Activity ...