Asked by Cristian Coronado on Apr 25, 2024

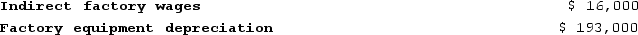

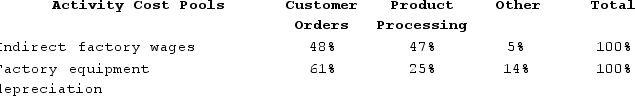

Beckley Corporation has provided the following data from its activity-based costing accounting system:

Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.

Activity-Based Costing

A pricing strategy that pinpoints various tasks within a company and allocates the expenses of each task to every product and service based on their real usage.

Idle Capacity

The condition where equipment or workspaces are not being used to their full potential, often resulting in inefficiency and lost productivity.

Resource Consumption

The usage of resources such as materials, labor, and energy in the production of goods or services.

- Accurately assign indirect expenses to products through the application of activity-based costing.

- Comprehend the distinction between attributing costs to products and the absence of such cost allocation.

Learning Objectives

- Accurately assign indirect expenses to products through the application of activity-based costing.

- Comprehend the distinction between attributing costs to products and the absence of such cost allocation.

Related questions

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...