Asked by Emily Talbot on May 19, 2024

Verified

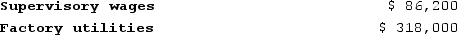

Desilets Corporation has provided the following data from its activity-based costing accounting system:

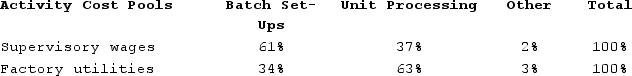

Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

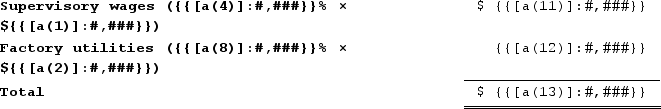

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Unit Processing activity cost pool.b. Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Unit Processing activity cost pool.b. Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.

Resource Consumption

The act of using resources, such as materials, time, and energy, in the process of producing goods and services.

Idle Capacity

The portion of a company's resources or production capacity that is not being used in production but still incurs costs.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to related products and services based on the activities they require.

- Accurately attribute indirect costs to products by applying the principles of activity-based costing.

- Recognize the variance in assigning financial charges to merchandise as opposed to neglecting this assignment.

Verified Answer

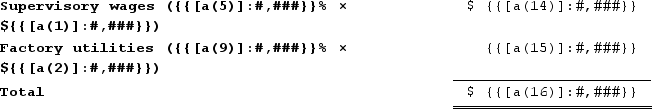

b. As stated in the problem, the costs allocated to the "Other" cost pool are not assigned to products.

b. As stated in the problem, the costs allocated to the "Other" cost pool are not assigned to products.

Learning Objectives

- Accurately attribute indirect costs to products by applying the principles of activity-based costing.

- Recognize the variance in assigning financial charges to merchandise as opposed to neglecting this assignment.

Related questions

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Mcnamee Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

Beckley Corporation Has Provided the Following Data from Its Activity-Based ...

The Following Data Have Been Provided by Hooey Corporation from ...