Asked by victoria burgos on May 29, 2024

Verified

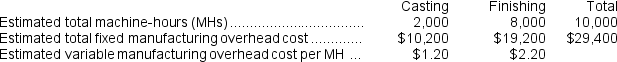

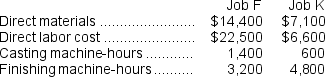

Lotz Corporation has two manufacturing departments--Casting and Finishing.The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job F and Job K.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job F and Job K.There were no beginning inventories.Data concerning those two jobs follow:  Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job F is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job F is closest to:

A) $30,220

B) $90,660

C) $60,440

D) $96,100

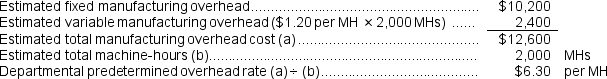

Departmental Predetermined Overhead Rates

Overhead rates calculated for specific departments within a manufacturing facility, reflecting the unique costs associated with each department's operations.

Machine-Hours

A measure of the time machines are used in the production process, often used as a basis for allocating overhead costs in a manufacturing environment.

Markup

The amount added to the cost price of goods to cover overhead and profit, expressed as a percentage of the cost.

- Determine the selling price of jobs based on manufacturing cost and markup.

Verified Answer

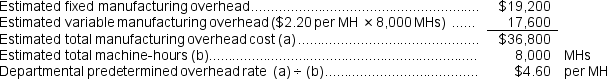

Finishing Department predetermined overhead rate:

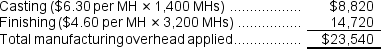

Finishing Department predetermined overhead rate:  Manufacturing overhead applied to Job F:

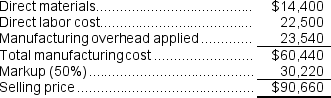

Manufacturing overhead applied to Job F:  The selling price for Job F would be calculated as follows:

The selling price for Job F would be calculated as follows:

Learning Objectives

- Determine the selling price of jobs based on manufacturing cost and markup.

Related questions

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Amason Corporation Has Two Production Departments, Forming and Assembly ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...