Asked by Brayan Checo Rosario on Jul 02, 2024

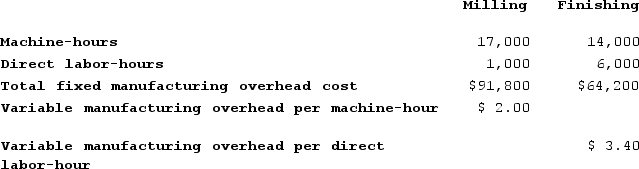

Dancel Corporation has two production departments, Milling and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

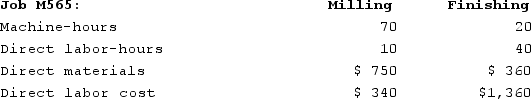

During the current month the company started and finished Job M565. The following data were recorded for this job:

During the current month the company started and finished Job M565. The following data were recorded for this job:

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Predetermined Overhead Rate

An estimated overhead cost rate used in cost accounting to allocate expected indirect costs to specific products or job orders based on a specific activity base.

Machine-Hours

A measure of production time, where one machine-hour equals one hour of operation of a machine.

Direct Labor-Hours

The total hours worked by employees that are directly involved in the manufacturing of products or providing services.

- Cultivate the skill to apply predetermined overhead rates in the realm of job-order costing.

- Measure the allocation of manufacturing overhead to jobs by analyzing machine hours and labor hours.

- Estimate the total financial outlay for producing specific jobs.

Learning Objectives

- Cultivate the skill to apply predetermined overhead rates in the realm of job-order costing.

- Measure the allocation of manufacturing overhead to jobs by analyzing machine hours and labor hours.

- Estimate the total financial outlay for producing specific jobs.

Related questions

Mccaughan Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Bulla Corporation Has Two Production Departments, Machining and Customizing ...

Bulla Corporation Has Two Production Departments, Machining and Customizing ...