Asked by Aaron Morris on May 28, 2024

Verified

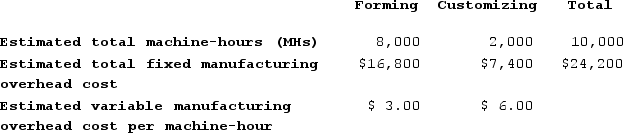

Hultquist Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead rates:

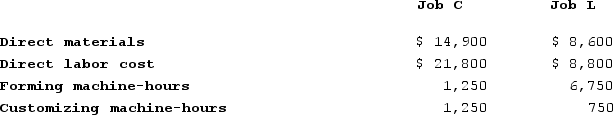

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Predetermined Overhead Rates

The estimated overhead rates used to assign manufacturing overhead costs to products or job orders, calculated before the period begins based on estimated costs and activity levels.

Machine-Hours

The total operating time of machinery used in the production process, expressed in hours, as a basis for allocating manufacturing overhead costs.

Forming

The process of shaping material into desired shapes by applying physical force or through the use of machinery.

- Integrate knowledge of predetermined overhead rates with practice in job-order costing.

- Carry out computation and hermeneutics of overhead rates designated for departments.

- Compute the distribution of manufacturing overhead to jobs in relation to machine hours and labor hours.

Verified Answer

![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1000_bf83_6fd5f6e79c17_TB8314_00.jpg) Customizing

Customizing![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1001_bf83_d98433217c88_TB8314_00.jpg) The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow:

The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1002_bf83_d3a7ba4c506a_TB8314_00.jpg) b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost:

b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1003_bf83_e9a01cd3a3a3_TB8314_00.jpg) d.The selling price for Job L:

d.The selling price for Job L:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1004_bf83_bb993ed38fe3_TB8314_00.jpg) e.Forming Department predetermined overhead rate:

e.Forming Department predetermined overhead rate:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1005_bf83_43dceb5f4ddc_TB8314_00.jpg) f.Customizing Department predetermined overhead rate:

f.Customizing Department predetermined overhead rate:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_1006_bf83_ff821e20182c_TB8314_00.jpg) g.Manufacturing overhead applied to Job L:

g.Manufacturing overhead applied to Job L:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_3717_bf83_b3cbc247a3cd_TB8314_00.jpg) h.The selling price for Job L would be calculated as follows:

h.The selling price for Job L would be calculated as follows:![a.The first step is to calculate the estimated total overhead costs in the two departments.Forming Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments (${{[a(20)]:#,###}} + ${{[a(21)]:#,###}} = ${{[a(24)]:#,###}}) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(14)]:#,###}} machine-hours + {{[a(16)]:#,###}} machine-hours)= ${{[a(25)]:#,###.00}} per machine-hour × ({{[a(26)]:#,###}} machine-hours)= ${{[a(27)]:#,###}}c.Job L's manufacturing cost: d.The selling price for Job L: e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6228_3718_bf83_39a50f394a93_TB8314_00.jpg)

Learning Objectives

- Integrate knowledge of predetermined overhead rates with practice in job-order costing.

- Carry out computation and hermeneutics of overhead rates designated for departments.

- Compute the distribution of manufacturing overhead to jobs in relation to machine hours and labor hours.

Related questions

Bulla Corporation Has Two Production Departments, Machining and Customizing ...

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Mccaughan Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

Bulla Corporation Has Two Production Departments, Machining and Customizing ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...