Asked by Brian Doherty on May 28, 2024

Verified

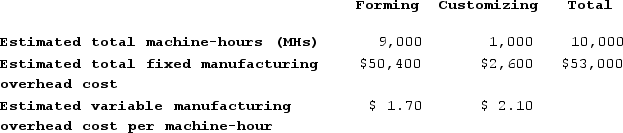

Hultquist Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead rates:

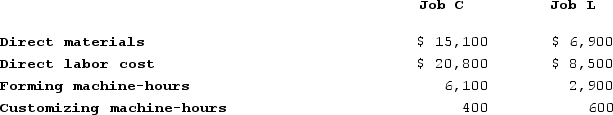

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow:

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.)

Predetermined Overhead Rates

Rates used to allocate manufacturing overhead costs to products or job orders, calculated based on estimated costs and activity levels.

Machine-Hours

A measure of production time that quantifies the number of hours machines are operated in the manufacturing process.

Forming

In the context of manufacturing, forming refers to the process of shaping materials into desired shapes through various methods, such as molding, casting, or stamping.

- Familiarize oneself with predetermined overhead rates and their usage in job-order costing.

- Calculate and analyze the overhead rates for various departments.

- Ascertain the allocation of manufacturing overhead to jobs, leveraging machine hours and labor hours.

Verified Answer

Customizing

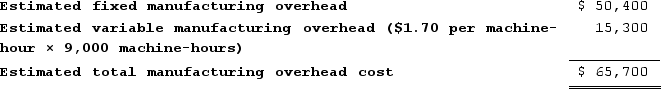

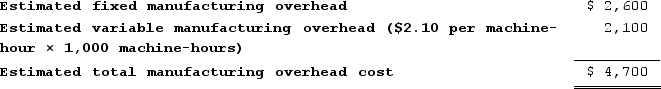

Customizing The second step is to combine the estimated manufacturing overhead costs in the two departments ($65,700 + $4,700 = $70,400) to calculate the plantwide predetermined overhead rate as follow:

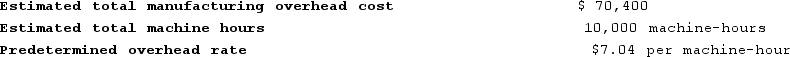

The second step is to combine the estimated manufacturing overhead costs in the two departments ($65,700 + $4,700 = $70,400) to calculate the plantwide predetermined overhead rate as follow: b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= $7.04 per machine-hour × (2,900 machine-hours + 600 machine-hours)= $7.04 per machine-hour × (3,500 machine-hours)= $24,640c.Job L's manufacturing cost:

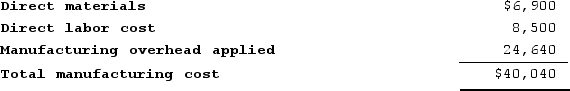

b.The overhead applied to Job L is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate × Machine-hours incurred by the job= $7.04 per machine-hour × (2,900 machine-hours + 600 machine-hours)= $7.04 per machine-hour × (3,500 machine-hours)= $24,640c.Job L's manufacturing cost: d.The selling price for Job L:

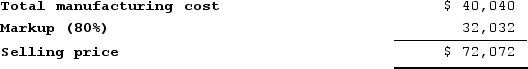

d.The selling price for Job L: e.Forming Department predetermined overhead rate:

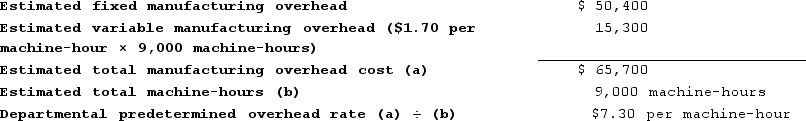

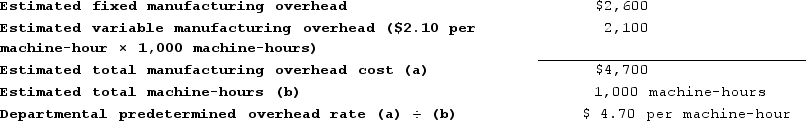

e.Forming Department predetermined overhead rate: f.Customizing Department predetermined overhead rate:

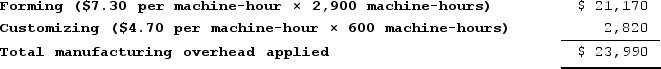

f.Customizing Department predetermined overhead rate: g.Manufacturing overhead applied to Job L:

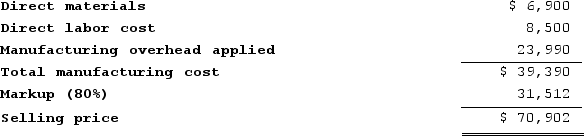

g.Manufacturing overhead applied to Job L: h.The selling price for Job L would be calculated as follows:

h.The selling price for Job L would be calculated as follows:

Learning Objectives

- Familiarize oneself with predetermined overhead rates and their usage in job-order costing.

- Calculate and analyze the overhead rates for various departments.

- Ascertain the allocation of manufacturing overhead to jobs, leveraging machine hours and labor hours.

Related questions

Bulla Corporation Has Two Production Departments, Machining and Customizing ...

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Mccaughan Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

Bulla Corporation Has Two Production Departments, Machining and Customizing ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...