Asked by Waseem Nazir on Apr 25, 2024

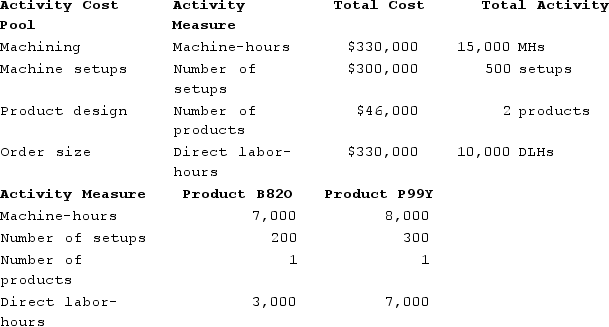

Immen Corporation manufactures two products: Product B82O and Product P99Y. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products B82O and P99Y.  Using the ABC system, how much total manufacturing overhead cost would be assigned to Product B82O?

Using the ABC system, how much total manufacturing overhead cost would be assigned to Product B82O?

A) $503,000

B) $297,000

C) $396,000

D) $99,000

Activity-based Costing

An accounting method that assigns costs to products or services based on the resources they consume.

- Calculate the allocation of overhead costs to individual products utilizing the activity-based costing methodology.

- Assess the outcome of utilizing an ABC system on the assignment of manufacturing overhead costs to various products.

Learning Objectives

- Calculate the allocation of overhead costs to individual products utilizing the activity-based costing methodology.

- Assess the outcome of utilizing an ABC system on the assignment of manufacturing overhead costs to various products.

Related questions

Bertsche Enterprises Makes a Variety of Products That It Sells ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Hane Corporation Uses the Following Activity Rates from Its Activity-Based ...

Weldon Corporation Has Provided the Following Data from Its Activity-Based ...

Thingvold, Inc ...