Asked by Writes Wanderlust on May 16, 2024

Verified

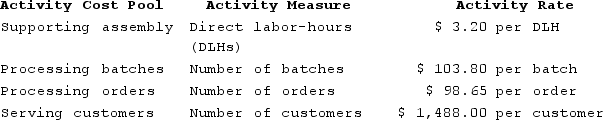

Bertsche Enterprises makes a variety of products that it sells to other businesses. The company's activity-based costing system has four activity cost pools for assigning costs to products and customers. Details concerning that ABC system are listed below:  The cost of serving customers, $1,488.00 per customer, is the cost of serving a customer for one year.Yousif Corporation buys only one of the company's products which Bertsche Enterprises sells for $25.00 per unit. Last year Yousif Corporation ordered a total of 900 units of this product in 3 orders. To fill the orders, 11 batches were required. The direct materials cost is $8.20 per unit and the direct labor cost is $7.65 per unit. Each unit requires 0.40 Direct labor-hours.According to the ABC system, the total cost of the activity "Supporting assembly" for this customer this past year was closest to:

The cost of serving customers, $1,488.00 per customer, is the cost of serving a customer for one year.Yousif Corporation buys only one of the company's products which Bertsche Enterprises sells for $25.00 per unit. Last year Yousif Corporation ordered a total of 900 units of this product in 3 orders. To fill the orders, 11 batches were required. The direct materials cost is $8.20 per unit and the direct labor cost is $7.65 per unit. Each unit requires 0.40 Direct labor-hours.According to the ABC system, the total cost of the activity "Supporting assembly" for this customer this past year was closest to:

A) $2,880.00

B) $1.28

C) $1,152.00

D) $360.00

Supporting Assembly

Components or sub-assemblies that are used as part of a main assembly in manufacturing processes.

Activity-based Costing

A financial approach that distributes overhead and indirect charges to associated goods and services based on the activities involved.

- Evaluate the assignment of overhead costs to distinct products by employing an activity-based costing technique.

Verified Answer

JE

Josie EdwardsMay 22, 2024

Final Answer :

C

Explanation :

First, we need to calculate the total cost of supporting assembly activity. Using the information from the table:

Supporting assembly activity cost = $48,000

Number of batches = 11

Therefore, cost per batch = $48,000/11 = $4,363.64

Now we can use this information to calculate the cost of supporting assembly activity for Yousif Corporation:

Number of batches for Yousif Corporation = 11/3 = 3.67, rounded up to 4 batches

Cost of supporting assembly activity for Yousif Corporation = $4,363.64 x 4 = $17,454.56

Finally, we can calculate the cost of serving Yousif Corporation for one year:

Cost of serving Yousif Corporation = $1,488.00 x 1 = $1,488.00

Adding up the total costs:

Total cost = Cost of supporting assembly activity + Cost of serving Yousif Corporation + Direct materials cost + Direct labor cost

Total cost = $17,454.56 + $1,488.00 + ($8.20 + $7.65) x 900 = $29,798.50

Dividing the total cost by the number of units:

Cost per unit = $29,798.50 / 900 = $33.11

Therefore, the total cost of the activity "Supporting assembly" for Yousif Corporation this past year was closest to $4,363.64 or $1,152.00 per order.

Supporting assembly activity cost = $48,000

Number of batches = 11

Therefore, cost per batch = $48,000/11 = $4,363.64

Now we can use this information to calculate the cost of supporting assembly activity for Yousif Corporation:

Number of batches for Yousif Corporation = 11/3 = 3.67, rounded up to 4 batches

Cost of supporting assembly activity for Yousif Corporation = $4,363.64 x 4 = $17,454.56

Finally, we can calculate the cost of serving Yousif Corporation for one year:

Cost of serving Yousif Corporation = $1,488.00 x 1 = $1,488.00

Adding up the total costs:

Total cost = Cost of supporting assembly activity + Cost of serving Yousif Corporation + Direct materials cost + Direct labor cost

Total cost = $17,454.56 + $1,488.00 + ($8.20 + $7.65) x 900 = $29,798.50

Dividing the total cost by the number of units:

Cost per unit = $29,798.50 / 900 = $33.11

Therefore, the total cost of the activity "Supporting assembly" for Yousif Corporation this past year was closest to $4,363.64 or $1,152.00 per order.

Learning Objectives

- Evaluate the assignment of overhead costs to distinct products by employing an activity-based costing technique.

Related questions

Weldon Corporation Has Provided the Following Data from Its Activity-Based ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Hane Corporation Uses the Following Activity Rates from Its Activity-Based ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Thingvold, Inc ...