Asked by Nicholas Malmquist on Apr 24, 2024

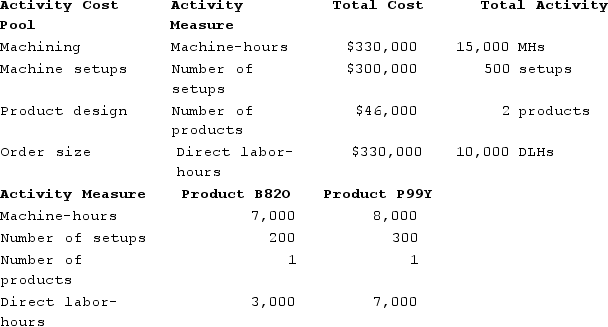

Immen Corporation manufactures two products: Product B82O and Product P99Y. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products B82O and P99Y.  Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product B82O?

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product B82O?

A) $704,200

B) $301,800

C) $610,000

D) $503,000

Plantwide Overhead Rate

A single overhead allocation rate used throughout a manufacturing plant or entire facility, applied uniformly to all products or cost centers.

Activity-based Costing

A costing method that assigns overhead and indirect costs to related products and services based on the activities that generate costs.

- Inspect the impact that adopting an ABC system has on distributing manufacturing overhead costs across different products.

- Contrast the application of a plantwide overhead rate against activity-based costing techniques in the apportionment of overhead charges.

Learning Objectives

- Inspect the impact that adopting an ABC system has on distributing manufacturing overhead costs across different products.

- Contrast the application of a plantwide overhead rate against activity-based costing techniques in the apportionment of overhead charges.