Asked by Praveeni Sooriyamudali on May 19, 2024

Verified

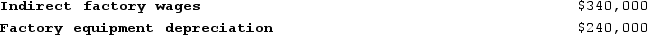

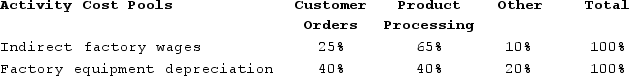

Weldon Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

A) $188,500

B) $181,000

C) $290,000

D) $580,000

Customer Orders

Requests placed by customers for the purchase of goods or services from a company.

- Ascertain the apportionment of overhead expenses to specific products via the activity-based costing framework.

Verified Answer

TG

Tarapada GhoshMay 21, 2024

Final Answer :

B

Explanation :

From the table, we can see that indirect factory wages and factory equipment depreciation costs are both part of the "Processing Customer Orders" activity cost pool. Therefore, we need to look at the allocation rates for these two costs in that pool.

Indirect factory wages have an allocation rate of $15 per direct labor-hour, and factory equipment depreciation has an allocation rate of $18 per machine-hour.

To calculate the amount of indirect factory wages assigned to the Customer Orders activity cost pool, we first need to determine the number of direct labor-hours associated with that pool. This is given to us as 12,100 direct labor-hours.

So, the amount of indirect factory wages assigned to the Customer Orders activity cost pool would be:

12,100 direct labor-hours x $15 per direct labor-hour = $181,500

To calculate the amount of factory equipment depreciation assigned to the Customer Orders activity cost pool, we need to determine the number of machine-hours associated with that pool. This is given to us as 16,000 machine-hours.

So, the amount of factory equipment depreciation assigned to the Customer Orders activity cost pool would be:

16,000 machine-hours x $18 per machine-hour = $288,000

Therefore, the total amount of indirect factory wages and factory equipment depreciation cost assigned to the Customer Orders activity cost pool would be:

$181,500 + $288,000 = $469,500

The closest answer choice to this amount is B, $181,000.

Indirect factory wages have an allocation rate of $15 per direct labor-hour, and factory equipment depreciation has an allocation rate of $18 per machine-hour.

To calculate the amount of indirect factory wages assigned to the Customer Orders activity cost pool, we first need to determine the number of direct labor-hours associated with that pool. This is given to us as 12,100 direct labor-hours.

So, the amount of indirect factory wages assigned to the Customer Orders activity cost pool would be:

12,100 direct labor-hours x $15 per direct labor-hour = $181,500

To calculate the amount of factory equipment depreciation assigned to the Customer Orders activity cost pool, we need to determine the number of machine-hours associated with that pool. This is given to us as 16,000 machine-hours.

So, the amount of factory equipment depreciation assigned to the Customer Orders activity cost pool would be:

16,000 machine-hours x $18 per machine-hour = $288,000

Therefore, the total amount of indirect factory wages and factory equipment depreciation cost assigned to the Customer Orders activity cost pool would be:

$181,500 + $288,000 = $469,500

The closest answer choice to this amount is B, $181,000.

Learning Objectives

- Ascertain the apportionment of overhead expenses to specific products via the activity-based costing framework.

Related questions

Hane Corporation Uses the Following Activity Rates from Its Activity-Based ...

Bertsche Enterprises Makes a Variety of Products That It Sells ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Thingvold, Inc ...