Asked by Dan Francis Rodriguez on May 12, 2024

Verified

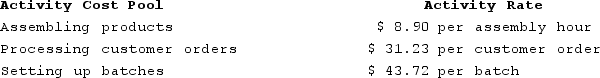

Hane Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

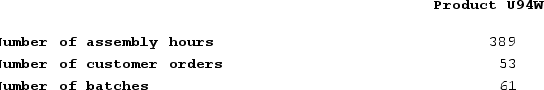

Data for one of the company's products follow:

How much overhead cost would be assigned to Product U94W using the activity-based costing system?

How much overhead cost would be assigned to Product U94W using the activity-based costing system?

A) $42,176.55

B) $83.85

C) $7,784.21

D) $2,666.92

Activity-based Costing

A costing method that assigns overhead and indirect costs to related products and services based on their usage of activities.

Overhead Cost

General expenses related to the operation of a business that are not directly tied to a specific product or service, including rent, utilities, and administrative expenses.

- Establish the overhead costs allocated to particular products through the implementation of an activity-based costing system.

Verified Answer

ZK

Zybrea KnightMay 16, 2024

Final Answer :

C

Explanation :

To calculate the overhead cost assigned to Product U94W, we need to multiply the activity rate of each activity by the corresponding amount of activity used by U94W, then add up the results.

Activity 1: $0.35 x 34,500 = $12,075

Activity 2: $2.25 x 1,500 = $3,375

Activity 3: $0.25 x 30,000 = $7,500

Activity 4: $13 x 45 = $585

Total overhead cost assigned to U94W = $23,535

Therefore Choice C is the correct answer.

Activity 1: $0.35 x 34,500 = $12,075

Activity 2: $2.25 x 1,500 = $3,375

Activity 3: $0.25 x 30,000 = $7,500

Activity 4: $13 x 45 = $585

Total overhead cost assigned to U94W = $23,535

Therefore Choice C is the correct answer.

Learning Objectives

- Establish the overhead costs allocated to particular products through the implementation of an activity-based costing system.

Related questions

Weldon Corporation Has Provided the Following Data from Its Activity-Based ...

Bertsche Enterprises Makes a Variety of Products That It Sells ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Thingvold, Inc ...