Asked by louis rojas on Jun 29, 2024

Verified

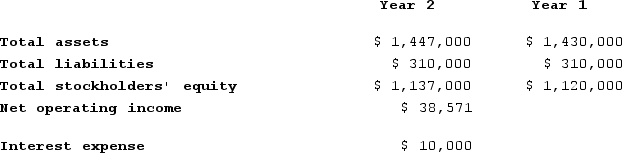

Fraction Corporation has provided the following financial data:

Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?

Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?

Times Interest Earned

An indicator of how well a business can fulfill its debt repayments by evaluating its earnings prior to interest and taxes against its interest expenditures.

Debt-To-Equity Ratio

An indicator of how a firm's assets are funded, reflecting the ratio of equity and debt in financing.

Equity Multiplier

A financial leverage ratio that measures the portion of a company's assets that are financed by shareholders' equity.

- Comprehend the methods for computing and interpreting fundamental financial ratios.

- Evaluate the balance between leverage and risk through the analysis of debt and equity ratios.

Verified Answer

GA

Gissela Aparicio LopezJul 02, 2024

Final Answer :

a.Times interest earned ratio = Earnings before interest expense and income taxes ÷ Interest expense= $38,571 ÷ $10,000 = 3.86 (rounded)b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity= $310,000 ÷ $1,137,000 = 0.27 (rounded)c.Equity multiplier = Average total assets* ÷ Average stockholders' equity*= $1,438,500÷$1,128,500 = 1.27 (rounded)*Average total assets = ($1,447,000 + $1,430,000) ÷ 2 = $1,438,500 **Average stockholders' equity = ($1,137,000 + $1,120,000) ÷ 2 = $1,128,500

Learning Objectives

- Comprehend the methods for computing and interpreting fundamental financial ratios.

- Evaluate the balance between leverage and risk through the analysis of debt and equity ratios.