Asked by Parker Murdie on Apr 25, 2024

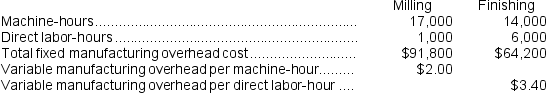

Dancel Corporation has two production departments, Milling and Finishing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Milling Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job M565.The following data were recorded for this job:

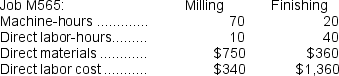

During the current month the company started and finished Job M565.The following data were recorded for this job:  Required:

Required:

a.Calculate the total amount of overhead applied to Job M565 in both departments.

b.Calculate the total job cost for Job M565.

c.Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Direct Labor-Hours

The total hours worked by employees who are directly involved in the manufacturing process and whose work can be easily traced to the product.

Manufacturing Overhead

All production costs other than direct labor and direct materials, which are incurred in the manufacturing process.

- Compute the overall expenses of a job by applying the principles of job-order costing.

- Employ data on manufacturing expenses to establish retail prices through the application of markup ratios.

- Compute and implement predetermined overhead rates for departments.

Learning Objectives

- Compute the overall expenses of a job by applying the principles of job-order costing.

- Employ data on manufacturing expenses to establish retail prices through the application of markup ratios.

- Compute and implement predetermined overhead rates for departments.

Related questions

Teasley Corporation Uses a Job-Order Costing System with a Single ...

Carcana Corporation Has Two Manufacturing Departments--Machining and Finishing ...

Cardosa Corporation Uses a Job-Order Costing System with a Single ...

Tarrant Corporation Has Two Manufacturing Departments--Casting and Finishing ...

Opunui Corporation Has Two Manufacturing Departments--Molding and Finishing ...