Asked by Wenlu Zhang on Jul 02, 2024

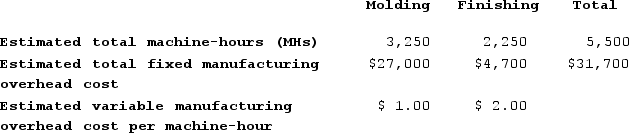

Opunui Corporation has two manufacturing departments--Molding and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job M. There were no beginning inventories. Data concerning those two jobs follow:

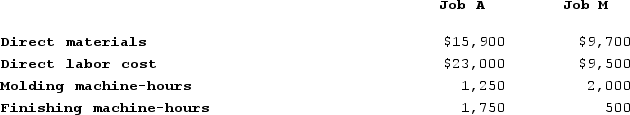

During the most recent month, the company started and completed two jobs--Job A and Job M. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 30% on manufacturing cost to establish selling prices. The calculated selling price for Job A is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 30% on manufacturing cost to establish selling prices. The calculated selling price for Job A is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $60,410

B) $78,533

C) $99,860

D) $18,123

Predetermined Overhead Rate

A rate used to allocate overhead costs to products or services, based on a predetermined activity level.

Manufacturing Departments

Sections in a manufacturing plant, each focusing on various parts of the manufacturing process.

Machine-Hours

The total hours that machinery is in operation during a production process.

- Calculate and understand selling prices based on manufacturing costs and markup percentages.

Learning Objectives

- Calculate and understand selling prices based on manufacturing costs and markup percentages.

Related questions

Nielsen Corporation Has Two Manufacturing Departments--Machining and Assembly ...

Lupo Corporation Uses a Job-Order Costing System with a Single ...

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Carcana Corporation Has Two Manufacturing Departments--Machining and Finishing ...

Cull Corporation Uses a Job-Order Costing System with a Single ...