Asked by Elizabeth Ridgeway on May 29, 2024

Verified

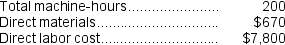

Teasley Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on 70,000 machine-hours, total fixed manufacturing overhead cost of $630,000, and a variable manufacturing overhead rate of $3.40 per machine-hour.Job X159 was recently completed.The job cost sheet for the job contained the following data:  Required:

Required:

Calculate the total job cost for Job X159.

Machine-Hours

A unit of measure indicating the duration machines are in operation in a manufacturing setting, critical in cost allocation and efficiency studies.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated before the period begins based on estimated costs.

Variable Manufacturing Overhead

Costs incurred during the production process that vary with the level of production, such as utilities for the manufacturing plant.

- Calculate the total expenditure of a job by applying the tenets of job-order costing.

Verified Answer

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $868,000 ÷ 70,000 machine-hours = $12.40 per machine-hour

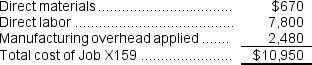

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $12.40 per machine-hour × 200 machine-hours = $2,480

Learning Objectives

- Calculate the total expenditure of a job by applying the tenets of job-order costing.

Related questions

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Cardosa Corporation Uses a Job-Order Costing System with a Single ...

Garner Company Begins Operations on July 1 2017 \quad \(\quad ...

Levron Corporation Uses a Job-Order Costing System with a Single ...

Wurzer Corporation Uses a Job-Order Costing System to Assign Manufacturing ...