Asked by Jahsiah Colon on Apr 29, 2024

Verified

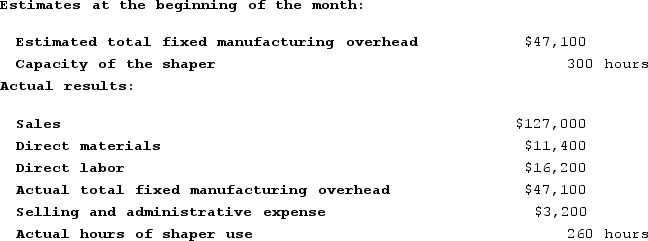

Coble Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated shaper. Additional information is provided below for the most recent month:  The manufacturing overhead applied is closest to:

The manufacturing overhead applied is closest to:

A) $16,933

B) $47,100

C) $3,200

D) $40,820

Job-Order Costing

A cost accounting system that calculates the cost of individual jobs or orders, commonly used in custom manufacturing.

Automated Shaper

A machine that uses computer controls to cut and shape materials with precision, often used in manufacturing for consistent and efficient production.

Manufacturing Overhead

Costs associated with manufacturing a product that are not directly tied to the factory's operations.

- Assign overhead expenses to goods using both conventional and activity-based cost accounting methods.

Verified Answer

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total machine hours

Estimated total manufacturing overhead cost = $435,000

Estimated total machine hours = 21,750

Therefore, the predetermined overhead rate = $435,000 ÷ 21,750 = $20 per machine hour

Actual machine hours used = 2,041

Therefore, the manufacturing overhead applied = $20 × 2,041 = $40,820

Thus, the closest answer is D, $40,820.

Learning Objectives

- Assign overhead expenses to goods using both conventional and activity-based cost accounting methods.

Related questions

Coble Woodworking Corporation Produces Fine Cabinets ...

The Overhead Applied to Each Unit of Product X2 Under ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Hane Corporation Uses the Following Activity Rates from Its Activity-Based ...

Weldon Corporation Has Provided the Following Data from Its Activity-Based ...