Asked by Tighe Avila on Jun 19, 2024

Verified

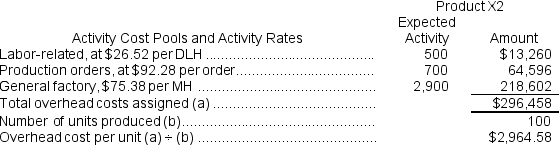

The overhead applied to each unit of Product X2 under activity-based costing is closest to:

A) $2,082.89 per unit

B) $2,186.02 per unit

C) $2,964.58 per unit

D) $1,837.85 per unit

Overhead Applied

The portion of estimated overhead costs that is allocated to each unit of production or activity based on a predetermined rate.

Activity-Based Costing

An accounting method that assigns costs to products and services based on the resources they consume. This approach seeks to provide more accurate cost information by attributing overhead costs to specific activities.

- Assess the costs associated with products under the framework of activity-based costing.

- Administer the distribution of overhead to products through the utilization of both traditional costing and activity-based costing strategies.

Verified Answer

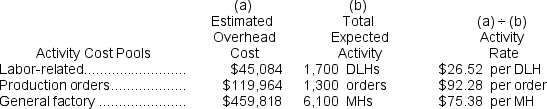

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Reference: CH04-Ref23

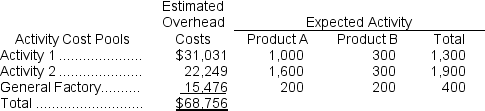

Reference: CH04-Ref23Adelberg Company has two products: A and B.The annual production and sales of Product A is 500 units and of Product B is 1,000 units.The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products.Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit.The total estimated overhead for next period is $68,756.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports.The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

Learning Objectives

- Assess the costs associated with products under the framework of activity-based costing.

- Administer the distribution of overhead to products through the utilization of both traditional costing and activity-based costing strategies.

Related questions

The Amount of Overhead Applied for Activity 3 During ...

Coble Woodworking Corporation Produces Fine Cabinets ...

Coble Woodworking Corporation Produces Fine Cabinets ...

The Unit Product Cost of Product N0 Under Activity-Based Costing ...

The Total Overhead Applied to Product A7 Under Activity-Based Costing ...