Asked by Huyen Nguyen on Jul 17, 2024

Verified

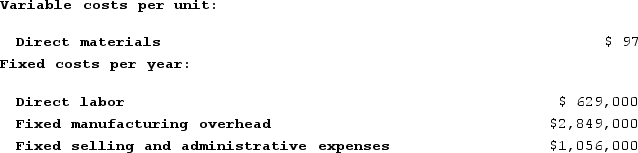

Buckbee Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.The net operating income for the year under super-variable costing is:

A) $799,000

B) $229,000

C) $714,000

D) $1,184,000

Net Operating Income

A measure of a property's profitability, calculated by subtracting all operating expenses from the gross operating income.

- Acquire insight into the basics of super-variable costing and its implications for net operating income.

- Derive the net operating income by the implementation of variable and super-variable costing frameworks.

Verified Answer

AB

Aubrey BurksJul 21, 2024

Final Answer :

C

Explanation :

Under super-variable costing, only variable manufacturing costs are considered as product costs. Fixed manufacturing costs are treated as period costs and are expensed in the period they are incurred.

Total variable manufacturing cost per unit = Direct materials per unit + Direct labor per unit = $75 + $52 = $127

Total fixed manufacturing cost per unit = Fixed manufacturing cost / Number of units produced = $555,000 / 37,000 = $15

Super-variable cost per unit = Total variable manufacturing cost per unit + Total fixed manufacturing cost per unit = $127 + $15 = $142

Revenue from sales = 32,000 x $261 = $8,352,000

Total super-variable cost of goods sold = 32,000 x $142 = $4,544,000

Gross margin = Revenue from sales - Total super-variable cost of goods sold = $3,808,000

Total fixed selling and administrative expenses for the year = $787,000

Net operating income under super-variable costing = Gross margin - Total fixed selling and administrative expenses = $3,808,000 - $787,000 = $3,021,000

Therefore, the net operating income for the year under super-variable costing is $714,000 (Option C).

Total variable manufacturing cost per unit = Direct materials per unit + Direct labor per unit = $75 + $52 = $127

Total fixed manufacturing cost per unit = Fixed manufacturing cost / Number of units produced = $555,000 / 37,000 = $15

Super-variable cost per unit = Total variable manufacturing cost per unit + Total fixed manufacturing cost per unit = $127 + $15 = $142

Revenue from sales = 32,000 x $261 = $8,352,000

Total super-variable cost of goods sold = 32,000 x $142 = $4,544,000

Gross margin = Revenue from sales - Total super-variable cost of goods sold = $3,808,000

Total fixed selling and administrative expenses for the year = $787,000

Net operating income under super-variable costing = Gross margin - Total fixed selling and administrative expenses = $3,808,000 - $787,000 = $3,021,000

Therefore, the net operating income for the year under super-variable costing is $714,000 (Option C).

Learning Objectives

- Acquire insight into the basics of super-variable costing and its implications for net operating income.

- Derive the net operating income by the implementation of variable and super-variable costing frameworks.

Related questions

Union Corporation Manufactures and Sells One Product ...

Labadie Corporation Manufactures and Sells One Product ...

Tustin Corporation Has Provided the Following Data for Its Two ...

Twisdale Corporation Manufactures Numerous Products, One of Which Is Called ...

Knappert Corporation Makes One Product and Has Provided the Following ...