Asked by Michael Hawthorne on May 08, 2024

Verified

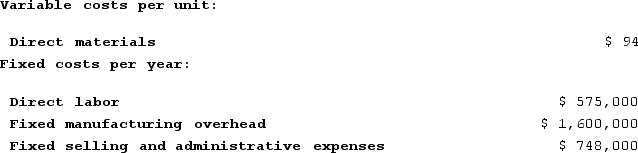

Labadie Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 25,000 units and sold 22,000 units. The company's only product is sold for $251 per unit.Assume that the company uses a variable costing system that assigns $23 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 25,000 units and sold 22,000 units. The company's only product is sold for $251 per unit.Assume that the company uses a variable costing system that assigns $23 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

A) $181 per unit

B) $117 per unit

C) $94 per unit

D) $215 per unit

Variable Costing

An accounting method that only allocates variable costs to inventory, treating fixed costs as expenses of the period.

Unit Product Cost

The total cost (direct materials, direct labor, and manufacturing overhead) divided by the number of units produced, representing the cost per individual unit.

Direct Labor Cost

Wages that are paid to workers who are directly involved in the production of goods or services.

- Gain an understanding of variable costing principles and their influence on net operating income.

- Determine the per-unit cost employing variable and absorption costing methodologies.

Verified Answer

Given,

Direct Labor Cost per unit = $23

Variable Manufacturing Overhead costs = 0

Therefore,

Unit Product Cost = Direct Materials Cost + Direct Labor Cost + Variable Manufacturing Overhead Cost

Unit Product Cost = $105 + $23 + $0

Unit Product Cost = $128

Hence, the unit product cost under the variable costing system is $128 per unit, which matches with option B).

Learning Objectives

- Gain an understanding of variable costing principles and their influence on net operating income.

- Determine the per-unit cost employing variable and absorption costing methodologies.

Related questions

The Unit Product Cost Under Variable Costing in Year 1 ...

The Unit Product Cost Under Absorption Costing in Year 1 ...

The Unit Product Cost Under Variable Costing in Year 1 ...

Shelko Corporation Manufactures and Sells One Product ...

Lefelmann Corporation, Which Has Only One Product, Has Provided the ...