Asked by drishika gulati on Apr 26, 2024

Verified

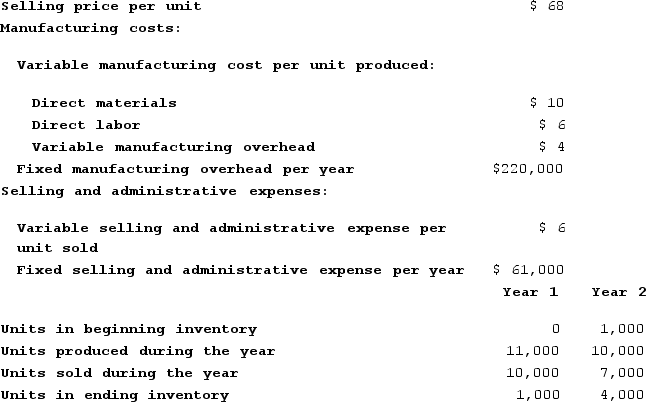

Tustin Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under variable costing in Year 1 is closest to:

The net operating income (loss) under variable costing in Year 1 is closest to:

A) $420,000

B) $480,000

C) $139,000

D) $159,000

Variable Costing

An accounting method where only the variable production costs are allocated to the product, while fixed costs are treated as period costs.

Net Operating Income

The total income from operations of a company before taxes and interest deductions.

- Derive the net operating income by implementing both absorption and variable costing frameworks.

- Analyze the impact of production and sales volume on net operating income.

Verified Answer

MS

Mohamed SaeedApr 30, 2024

Final Answer :

C

Explanation :

Under variable costing in Year 1, the net operating income was $319,000. In Year 2, it was $480,000. The difference between the two is an increase of $161,000. This increase is due solely to the increase in units sold (100,000 in Year 1 vs. 150,000 in Year 2), which means that the variable cost per unit remained constant at $10 per unit. Therefore, if the company had sold 100,000 units in Year 2, the net operating income under variable costing would have been the same as in Year 1, which is $319,000. However, the company actually sold 150,000 units in Year 2, which means that the net operating income under variable costing was $139,000 higher in Year 2 than in Year 1 ($480,000 - $319,000 = $161,000; $161,000 / 1.5 = $107,333; $319,000 + $107,333 = $426,333). Therefore, the closest answer choice is C, $139,000.

Learning Objectives

- Derive the net operating income by implementing both absorption and variable costing frameworks.

- Analyze the impact of production and sales volume on net operating income.

Related questions

Croft Corporation Produces a Single Product ...

The Net Operating Income (Loss)under Absorption Costing in Year 2 ...

The Net Operating Income (Loss)under Absorption Costing Closest To

The Net Operating Income (Loss)under Variable Costing in Year 2 ...

The Net Operating Income (Loss)under Variable Costing in Year 2 ...