Asked by Rajbeer Sandhu on May 05, 2024

Verified

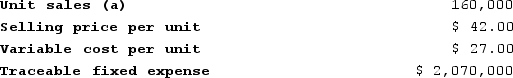

Twisdale Corporation manufactures numerous products, one of which is called Omicron-52. The company has provided the following data about this product:  Management is considering decreasing the price of Omicron-52 by 4%, from $42.00 to $40.32. The company's marketing managers estimate that this price reduction would increase unit sales by 5%, from 160,000 units to 168,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Omicron 52 earn at a price of $40.32 if this sales forecast is correct?

Management is considering decreasing the price of Omicron-52 by 4%, from $42.00 to $40.32. The company's marketing managers estimate that this price reduction would increase unit sales by 5%, from 160,000 units to 168,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Omicron 52 earn at a price of $40.32 if this sales forecast is correct?

A) $2,131,200

B) $61,200

C) $167,760

D) $2,237,760

Traceable Fixed Expense

Fixed costs that can be directly linked to a specific segment of a business and can be eliminated if the segment is removed.

Net Operating Income

The profit generated from a company's normal business operations, excluding expenses and revenues from investments and other non-operational sources.

Price Reduction

A decrease in the selling price of goods or services, typically aimed at increasing sales volume or clearing inventory.

- Master the procedures for evaluating net operating income in different pricing and sales environments.

- Recognize the consequence of fixed and variable costs on the net operating earnings.

Verified Answer

ZK

Zybrea KnightMay 08, 2024

Final Answer :

C

Explanation :

To calculate the net operating income, we need to first determine the contribution margin per unit:

Contribution margin per unit = Selling price per unit - Variable expenses per unit

The selling price per unit after the price reduction of 4% is $40.32, and the variable expenses per unit are given as follows:

Direct materials: $13.44

Direct labor: $5.04

Variable manufacturing overhead: $2.16

Variable selling expenses: $1.68

Total variable expenses per unit = $22.32

Contribution margin per unit = $40.32 - $22.32 = $18.00

Next, we can calculate the total contribution margin by multiplying the contribution margin per unit by the expected unit sales:

Total contribution margin = Contribution margin per unit x Expected unit sales

= $18.00 x 168,000 = $3,024,000

Since the total traceable fixed expenses do not change, the net operating income can be computed as follows:

Net operating income = Total contribution margin - Total traceable fixed expenses

= $3,024,000 - $2,856,240

= $167,760

Therefore, the correct answer is C.

Contribution margin per unit = Selling price per unit - Variable expenses per unit

The selling price per unit after the price reduction of 4% is $40.32, and the variable expenses per unit are given as follows:

Direct materials: $13.44

Direct labor: $5.04

Variable manufacturing overhead: $2.16

Variable selling expenses: $1.68

Total variable expenses per unit = $22.32

Contribution margin per unit = $40.32 - $22.32 = $18.00

Next, we can calculate the total contribution margin by multiplying the contribution margin per unit by the expected unit sales:

Total contribution margin = Contribution margin per unit x Expected unit sales

= $18.00 x 168,000 = $3,024,000

Since the total traceable fixed expenses do not change, the net operating income can be computed as follows:

Net operating income = Total contribution margin - Total traceable fixed expenses

= $3,024,000 - $2,856,240

= $167,760

Therefore, the correct answer is C.

Learning Objectives

- Master the procedures for evaluating net operating income in different pricing and sales environments.

- Recognize the consequence of fixed and variable costs on the net operating earnings.