Asked by Emily Treadaway on Apr 27, 2024

Verified

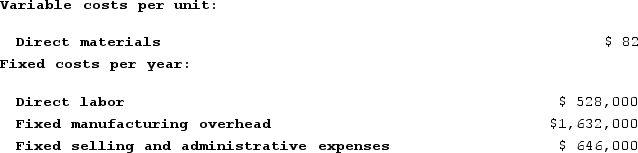

Union Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

A) $(102,000)

B) $374,000

C) $(830,000)

D) $(256,000)

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a unit of a product.

Net Operating Income

The total profit of a company after operating expenses are subtracted from operating revenues, but before deducting taxes and interest.

- Assess the net operating income through variable and super-variable costing procedures.

- Learn about the comparison between variable and absorption costing techniques.

- Evaluate the effects of fixed manufacturing overhead and direct labor costs on unit product costs and net operating income.

Verified Answer

Under absorption costing, the cost of each unit is:

Direct materials: $82

Direct labor: $22

Fixed overhead: $68

Total cost: $172

Therefore, the total cost of producing 24,000 units is:

24,000 units x $172 per unit = $4,128,000

Of these 24,000 units, only 17,000 were sold, leaving 7,000 units in ending inventory. The cost of these 7,000 units is:

7,000 units x $172 per unit = $1,204,000

The cost of goods sold is:

17,000 units x $172 per unit = $2,924,000

The revenue from selling these 17,000 units is:

17,000 units x $232 per unit = $3,944,000

Therefore, the net operating income is:

Revenue - Cost of goods sold - Fixed overhead deferred in inventory

= $3,944,000 - $2,924,000 - $1,204,000

= $374,000

The correct answer is B: $374,000.

Learning Objectives

- Assess the net operating income through variable and super-variable costing procedures.

- Learn about the comparison between variable and absorption costing techniques.

- Evaluate the effects of fixed manufacturing overhead and direct labor costs on unit product costs and net operating income.

Related questions

Buckbee Corporation Manufactures and Sells One Product ...

The Key Difference Between Variable Costing and Absorption Costing Is ...

A Variable Costing Income Statement Focuses Attention on the Relationship ...

Which of the Following Costing Methods Charges All Manufacturing Costs ...

Variable Costing Is the Only Acceptable Basis for Both External ...