Asked by Chasity Kleinsorge on Jun 18, 2024

Verified

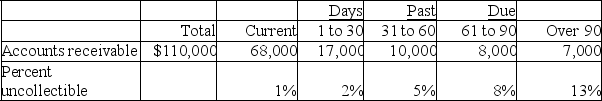

Bonita Company estimates uncollectible accounts using the allowance method at December 31.It prepared the following aging of receivables analysis.

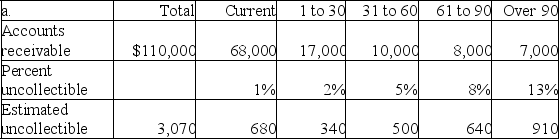

a.Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

a.Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

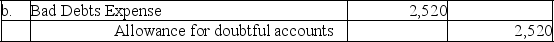

b.Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a.Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $550 credit.

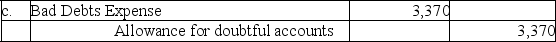

c.Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a.Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $300 debit.

Aging of Receivables Analysis

A method used to assess the financial health of a company's accounts receivable by categorizing outstanding invoices by their due dates.

Allowance for Doubtful Accounts

A contra-asset account used to estimate the portion of accounts receivable that is expected not to be collected.

Bad Debts Expense

The cost associated with accounts receivable that a company is unable to collect, recognized as an expense.

- Absorb the critical principles and processes essential for accounting practices regarding non-recoverable receivables.

- Learn to accurately estimate bad debts expense, through techniques like the allowance method and the direct write-off method.

- Understand how to use aged receivables to estimate the allowance for doubtful accounts.

Verified Answer

Learning Objectives

- Absorb the critical principles and processes essential for accounting practices regarding non-recoverable receivables.

- Learn to accurately estimate bad debts expense, through techniques like the allowance method and the direct write-off method.

- Understand how to use aged receivables to estimate the allowance for doubtful accounts.

Related questions

Owens Company Uses the Direct Write-Off Method of Accounting for ...

A Company Uses the Aging of Accounts Receivable Method to ...

Prepare General Journal Entries for the Following Transactions of Norman ...

At December 31 of the Current Year,a Company Reported the ...

On May 31,Cray Has $375,800 of Accounts Receivable ...

$3,070 - $550 = $2,520

$3,070 - $550 = $2,520 $3,070 + $300 = $3,370

$3,070 + $300 = $3,370