Asked by Logan Ann Moberly on May 22, 2024

Verified

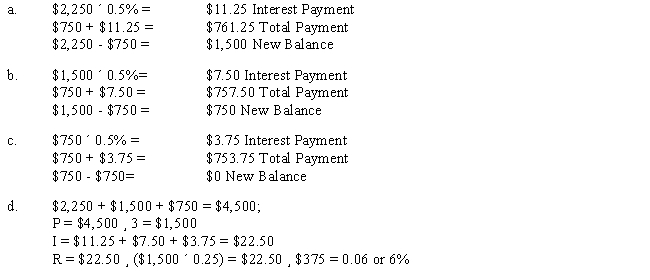

Billy North loaned $2,250 to his former college roommate, Jerold Weinsted. Jerold agreed to repay the principal in three monthly installments of $750 each. Billy charged interest at 0.5% (monthly rate) on the unpaid balance each month. Complete the North-Weinsted loan payment schedule. Then, use the North-Weinsted loan payment schedule to solve the effective rate problem.] ![Billy North loaned $2,250 to his former college roommate, Jerold Weinsted. Jerold agreed to repay the principal in three monthly installments of $750 each. Billy charged interest at 0.5% (monthly rate) on the unpaid balance each month. Complete the North-Weinsted loan payment schedule. Then, use the North-Weinsted loan payment schedule to solve the effective rate problem.]](https://d2lvgg3v3hfg70.cloudfront.net/TB3463/11eaab04_e8ad_6d93_acdb_4f74b60fc3cc_TB3463_00.jpg)

Effective Rate

The actual interest rate an individual pays on a loan or earns on an investment, accounting for compounding.

Monthly Rate

The interest or return generated by an investment or loan over a one-month period, often annualized for comparison purposes.

Loan Payment Schedule

A detailed plan showing the amount and timing of payments required to repay a loan, including both principal and interest components.

- Accomplish complete loan amortization schedules and tackle effective rate challenges.

Verified Answer

TT

Learning Objectives

- Accomplish complete loan amortization schedules and tackle effective rate challenges.