Asked by alysa butera on May 11, 2024

Verified

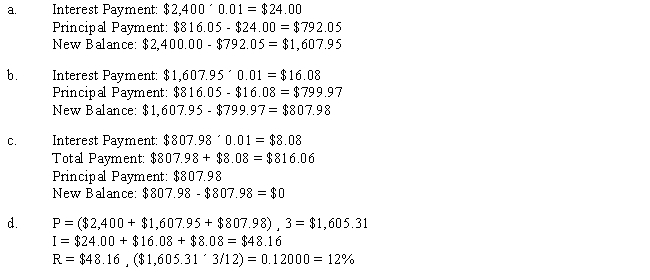

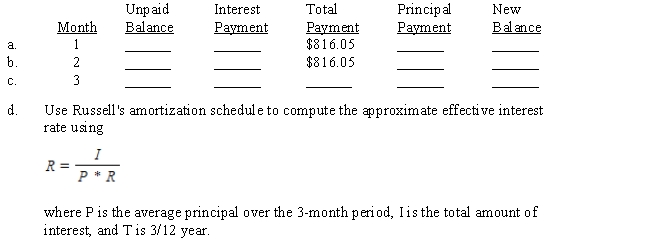

Eric Russell borrowed $2,400 from a financial loan company which amortized the loan at 12% over 3 months. Using Table 14-1, the first two monthly payments are $816.05. (The last payment may be slightly different.) Complete the amortization schedule and solve the effective rate problem.

Amortized Loan

A loan with scheduled periodic payments that consist of both principal and interest, designed to pay off the debt by the end of the term.

Effective Rate

The actual interest rate earned or paid on an investment, loan, or other financial product, accounting for the effect of compounding.

Amortization Schedule

A table detailing each periodic payment on an amortizing loan, including the portion of the payment that goes toward principal and interest over the loan term.

- Complete loan amortization schedules and solve effective rate problems.

Verified Answer

KH

Learning Objectives

- Complete loan amortization schedules and solve effective rate problems.