Asked by sidra jawad on May 25, 2024

Verified

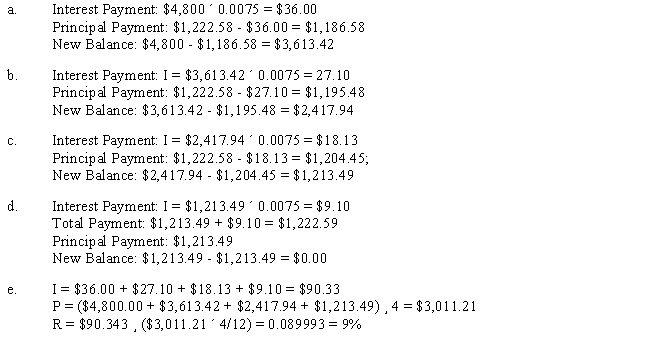

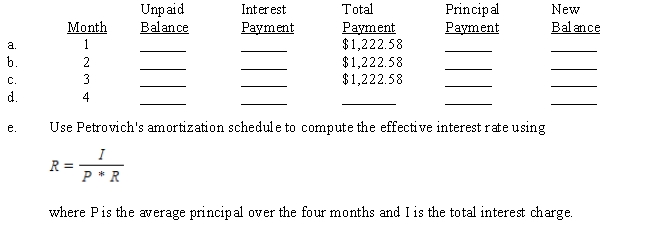

Alex Petrovich borrowed $4,800 from a finance company which amortized the loan at 9% over 4 months. Using Table 14-1, the first three monthly payments are $1,222.58 each. (The last payment may be slightly different.) Complete the amortization schedule and solve the effective rate problem.

Amortized Loan

A loan with scheduled periodic payments that consist of both principal and interest, designed to pay off the debt over a set period.

Effective Rate

The actual interest rate an investor receives or pays on a financial product, factoring in the effects of compounding.

Amortization Schedule

A table detailing each periodic payment on an amortizing loan, including breakdowns of principal and interest.

- Perform tasks related to loan amortization schedules and address effective rate problems.

Verified Answer

JC

Learning Objectives

- Perform tasks related to loan amortization schedules and address effective rate problems.