Asked by Claire Liang on Jun 15, 2024

Verified

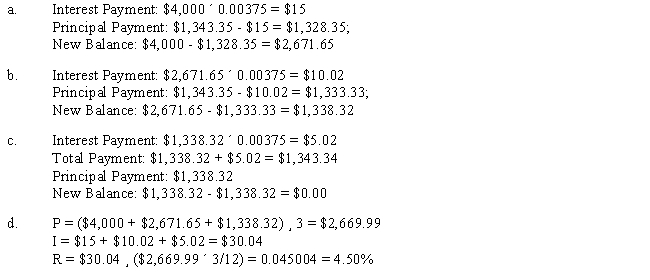

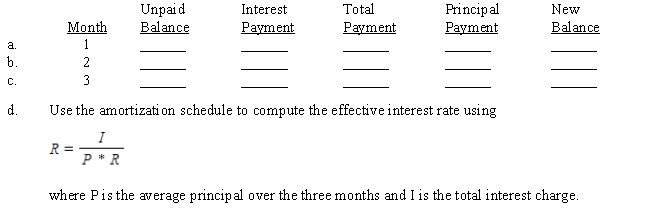

Cathy Cortez-Ochoa borrowed $4,000 from her uncle who amortized the loan at 4.5% over 3 months. Using Table 14-1, the first two monthly payments are $1,343.35 each. (The last payment may be slightly different.) Complete the amortization schedule and solve the effective rate problem.

Amortized Loan

a loan in which the principal and interest are paid down over time through fixed monthly payments.

Effective Rate

The effective rate, often referred to as the effective annual rate, is the interest rate on a loan or financial product re-compounded on a yearly basis.

Amortization Schedule

An amortization schedule is a table detailing each periodic payment on an amortizing loan, illustrating how the principal amount is reduced over time.

- Implement full loan amortization schedules and solve problems associated with effective rates.

Verified Answer

Learning Objectives

- Implement full loan amortization schedules and solve problems associated with effective rates.

Related questions

Alex Petrovich Borrowed $4,800 from a Finance Company Which Amortized ...

Eric Russell Borrowed $2,400 from a Financial Loan Company Which ...

Billy North Loaned $2,250 to His Former College Roommate, Jerold ...

Campbell Financing Corp ...

Arnold and Lorna Sampson Wanted to Borrow $35,000 to Remodel ...