Asked by Anne Marie Kratz on Jun 04, 2024

Verified

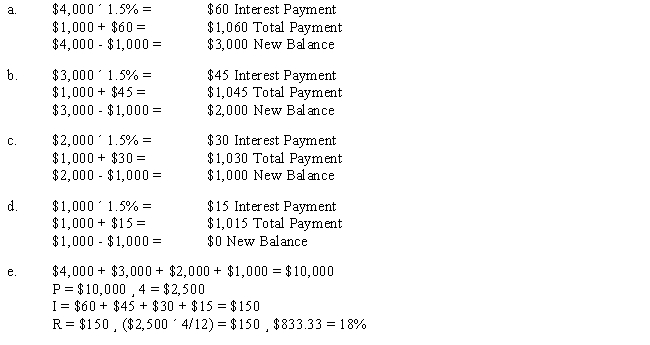

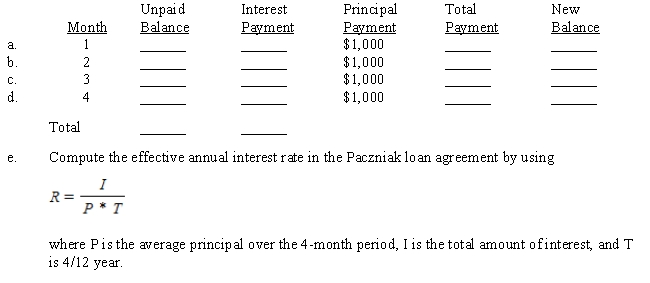

Melinda Paczniak borrowed $4,000 from a private source. Melinda agreed to repay the principal in four installments of $1,000 each. In addition, she paid interest each month, which was calculated by taking 1.5% (monthly rate) of the unpaid balance. Complete Melinda's loan payment schedule. Then, use Melinda's loan payment schedule to solve the effective rate problem.

Effective Rate

The actual interest rate on an investment or loan, taking into account the compounding of interest, as opposed to the nominal rate.

Monthly Rate

The interest rate or any other rate measured over the period of one month, often expressed as a percentage per month.

Principal

The person (client) for whom a service is performed. Amount that is borrowed using credit.

- Finalize complete loan amortization schedules and deal with effective rate problems effectively.

Verified Answer

AS

Learning Objectives

- Finalize complete loan amortization schedules and deal with effective rate problems effectively.

Related questions

Eric Russell Borrowed $2,400 from a Financial Loan Company Which ...

Alex Petrovich Borrowed $4,800 from a Finance Company Which Amortized ...

Billy North Loaned $2,250 to His Former College Roommate, Jerold ...

Campbell Financing Corp ...

Arnold and Lorna Sampson Wanted to Borrow $35,000 to Remodel ...