Asked by jeremiah coleman on Jun 12, 2024

Verified

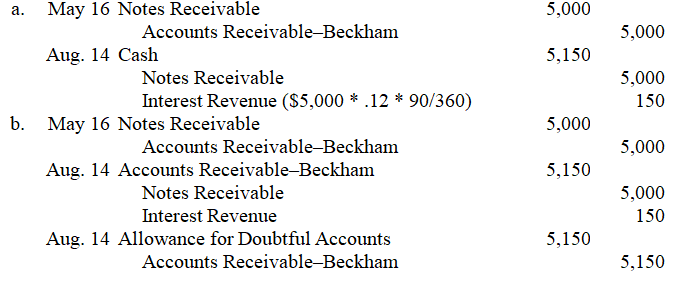

Jordan Co.uses the allowance method of accounting for uncollectible accounts.Jordan Co.accepted a $5,000,12%,90-day note dated May 16,from Beckam Co.in exchange for its past-due account receivable.Make the necessary general journal entries for Jordan Co.on May 16 and the August 14 maturity date,assuming that the:

a.Note is held until maturity and collected in full at that time.

b.Note is dishonored; the amount of the note and its interest are written off as uncollectible.

Allowance Method

An accounting technique used to estimate and record bad debts expense by anticipating uncollectible accounts.

Note Receivable

A financial asset representing a written promise to receive a specific amount of money at a future date.

Dishonored Note

A promissory note that has not been paid by the maker at the time of maturity, resulting in default.

- Gain insight into the underlying principles and processes used in keeping track of uncollectible receivables.

- Become familiar with the procedures and bookkeeping practices for notes receivable, with a focus on interest calculation, maturity date determination, and resolution of unpaid notes.

Verified Answer

AA

Learning Objectives

- Gain insight into the underlying principles and processes used in keeping track of uncollectible receivables.

- Become familiar with the procedures and bookkeeping practices for notes receivable, with a focus on interest calculation, maturity date determination, and resolution of unpaid notes.

Related questions

Prepare General Journal Entries for the Following Transactions of Norman ...

At December 31 of the Current Year,a Company Reported the ...

When the Maker of a Note Is Unable or Refuses ...

Thatcher Company Had a January 1,credit Balance in Its Allowance ...

A Company Has the Following Unadjusted Account Balances at December ...