Asked by gillian williams on May 20, 2024

Verified

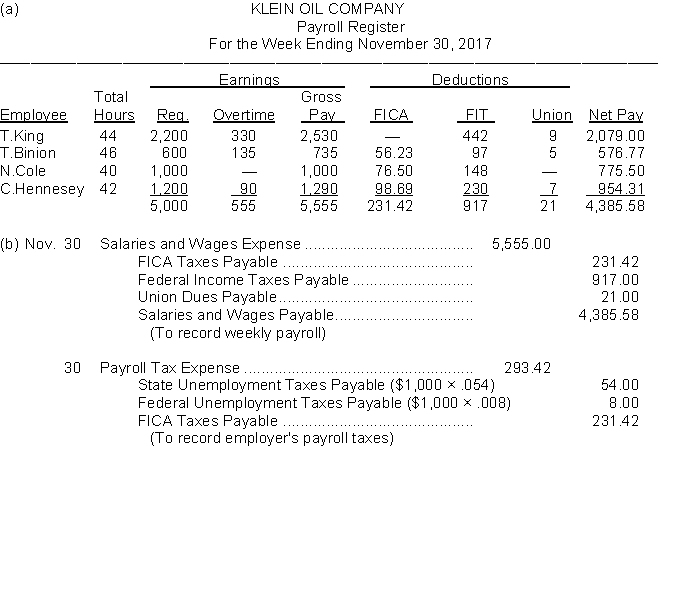

Assume that the payroll records of Klein Oil Company provided the following information for the weekly payroll ended November 30 2017.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117000 of each employee's annual earnings. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

FICA Tax Rate

The combined rate for Social Security and Medicare taxes that both employers and employees pay, based on a percentage of employees' wages.

Unemployment Taxes

Taxes that employers are required to pay to the government, which are used to fund unemployment benefits for workers who have lost their jobs.

Overtime Pay

Additional compensation paid to employees for hours worked beyond the standard workweek.

- Proficiency in the calculation of payroll, which includes determining gross wages, tax deductions, and take-home pay.

- Comprehend the methodology and accounting procedures for payroll tax expenditures.

Verified Answer

Learning Objectives

- Proficiency in the calculation of payroll, which includes determining gross wages, tax deductions, and take-home pay.

- Comprehend the methodology and accounting procedures for payroll tax expenditures.

Related questions

An Employee Earned $4,600 in February Working for an Employer ...

The Following Information Is for Employee Ella Dodd for the ...

Baker Green's Weekly Gross Earnings for the Week Ending December ...

An Employee Receives an Hourly Rate of $45, with Time ...

Perez Company Has the Following Information for the Pay Period ...