Asked by Marin Webster hannon on Jun 15, 2024

Verified

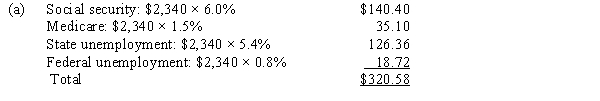

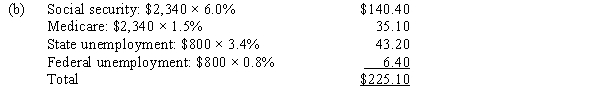

An employee receives an hourly rate of $45, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $950; social security tax rate, 6.0%; and Medicare tax rate, 1.5%; state unemployment compensation tax, 5.4% on the first $7,000; federal unemployment compensation tax, 0.8% on the first $7,000.Calculate the employer's payroll tax expense if:

(a) this is the first payroll of the year and the employee has no cumulative earnings for the year to date.(b) the employee's cumulative earnings for the year prior to this week equal $6,200.

Social Security Tax

A payroll tax that funds the Social Security program, which provides benefits for retirees, disabled persons, and survivors.

Medicare Tax

A federal tax deducted from employees' wages and matched by employers to fund the Medicare program, providing health insurance for individuals over 65.

Unemployment Compensation Tax

A tax paid by employers based on the wages of their employees, used to fund the unemployment insurance program.

- Grasp the accounting process for payroll, including calculations of net pay, deductions, and employer tax expenses.

Verified Answer

Learning Objectives

- Grasp the accounting process for payroll, including calculations of net pay, deductions, and employer tax expenses.

Related questions

The Following Information Is for Employee Ella Dodd for the ...

Baker Green's Weekly Gross Earnings for the Week Ending December ...

Perez Company Has the Following Information for the Pay Period ...

An Employee Earned $4,600 in February Working for an Employer ...

Gross Earnings Minus Total Deductions Equal ________ Earnings