Asked by Keely Mizenburg on Jun 23, 2024

Verified

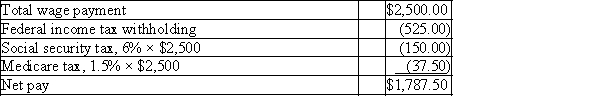

Baker Green's weekly gross earnings for the week ending December 7 were $2,500, and her federal income tax withholding was $525. Assuming the social security rate is 6% and Medicare is 1.5%, and all earnings are subject to FICA taxes, what is Green's net pay?

Social Security Rate

The percentage rate at which income is taxed to fund the Social Security program.

Medicare

A federal health insurance program in the United States primarily for people who are 65 or older, as well as for some younger people with disabilities.

Net Pay

The amount of money received by an employee after all deductions, such as taxes and retirement contributions, have been subtracted from their gross salary.

- Master the operational aspects of payroll accounting, which encompasses the computation of employees’ net earnings, deductions, and employer’s tax obligations.

Verified Answer

Learning Objectives

- Master the operational aspects of payroll accounting, which encompasses the computation of employees’ net earnings, deductions, and employer’s tax obligations.

Related questions

The Following Information Is for Employee Ella Dodd for the ...

An Employee Receives an Hourly Rate of $45, with Time ...

Perez Company Has the Following Information for the Pay Period ...

An Employee Earned $4,600 in February Working for an Employer ...

Gross Earnings Minus Total Deductions Equal ________ Earnings