Asked by Frank Guzman on Jul 07, 2024

Verified

The following information is for employee Ella Dodd for the week ended March 15.Total hours worked: 48

Rate: $15 per hour, with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% with no maximum earnings.Medicare tax: 1.5% on all earnings.State unemployment: 5.4% with no maximum earnings; on employer

Federal unemployment: 0.8% with no maximum earnings; on employer

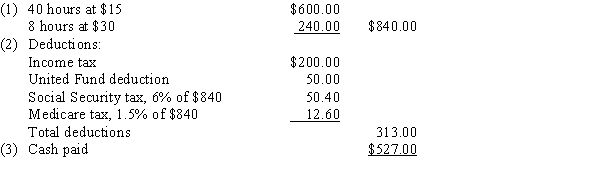

(a)Determine (1) total earnings, (2) total deductions, and (3) cash paid.(b)Determine each of the employer's payroll taxes related to the earnings of Ella Dodd for the week ended March 15.

Double Time

A pay rate that is twice the employee's regular hourly rate, often applied for working on holidays or overtime.

Cumulative Earnings

The total amount of net income earned by an individual or entity over a period, often used in the context of calculating pensions or other benefits.

- Become familiar with the processes of payroll accounting, including how to calculate net income, subtract deductions, and assess employer taxation expenses.

- Derive the payroll tax calculations for employers using the applicable tax rates and given payroll information.

Verified Answer

TD

Learning Objectives

- Become familiar with the processes of payroll accounting, including how to calculate net income, subtract deductions, and assess employer taxation expenses.

- Derive the payroll tax calculations for employers using the applicable tax rates and given payroll information.

Related questions

Baker Green's Weekly Gross Earnings for the Week Ending December ...

An Employee Receives an Hourly Rate of $45, with Time ...

Perez Company Has the Following Information for the Pay Period ...

An Employee Earned $4,600 in February Working for an Employer ...

Gross Earnings Minus Total Deductions Equal ________ Earnings

(b)

(b)